European electric vehicle sales data for August 2024 is disappointing for both electric vehicles and the entire automotive industry

- The European Automobile Manufacturers Association (ACEA) said the European electric vehicle market is facing a “continued downward trend”.

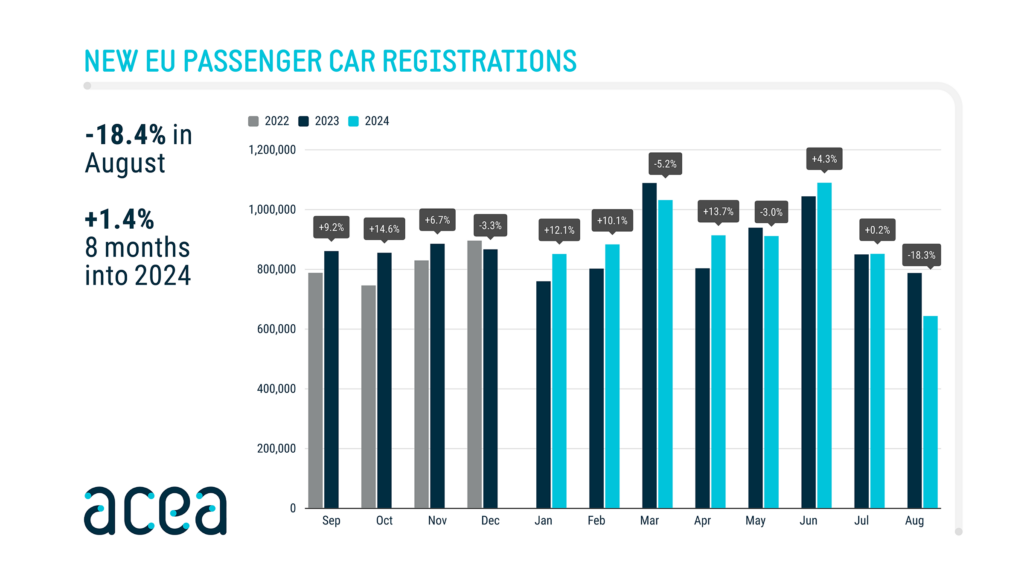

- In August, electric vehicle sales fell 43.9%, and the overall market fell 18.3% year-on-year.

- Automakers are seeking a smoother transition to zero-emission mobility amid sluggish demand for electric vehicles.

The impact of slowing electric vehicle sales is being felt across Europe, prompting automakers to urgently call for a “short-term relaxation” of stringent CO2 emissions targets. In August 2024, EU battery electric vehicle (BEV) sales plunged 43.9% year-on-year, significantly dragging down overall market sales.

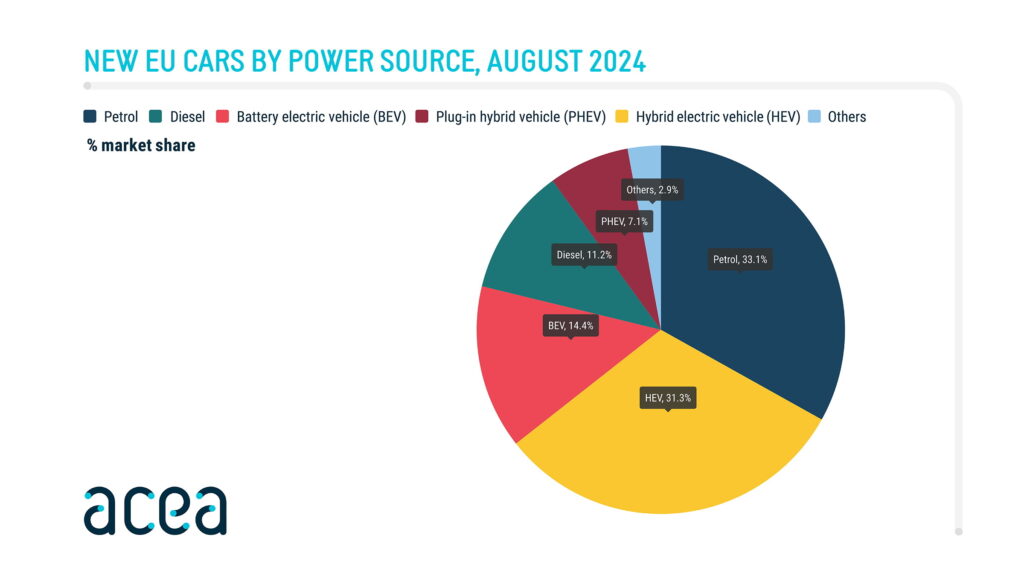

According to sales data released by the European Automobile Manufacturers Association (ACEA), sales of pure electric vehicles in August 2024 were only 92,627, a sharp drop from 165,204 in the same period last year. This sharp decline has caused the market share of pure electric vehicles to shrink from 21% to 14.4%.

MORE: U.S. electric vehicle sales soar thanks to generous incentives

This was the fourth consecutive month of falling sales, mainly due to a sharp drop in sales in Europe, the largest pure electric vehicle market. As we recently reported, sales in Germany fell by 68.8%, and in France they also fell by 33.1%.

Overall sales fell to the lowest point since 2021

In August 2024, new car registrations totaled 643,637 units, down 18.3% compared to August 2023. This sharp drop is the lowest sales figure in three years.

Gasoline-powered car sales fell 17.1% to 213,057 units. Diesel car sales fell 26.4% to 72,177 units, while plug-in hybrid car sales fell 22.3% to 45,590 units. Interestingly, only hybrid car sales increased, up 6.6% to 201,552 units, suggesting that there is still hope for a recovery in the market in the future.

That

Regulatory issues and future implications

The low market share of electric vehicles in the European Union, at just 12.6% with 902,011 registrations so far this year, is a wake-up call for the automotive industry. Carmakers have invested billions of dollars in electrification efforts to comply with strict emissions regulations and prepare for Europe’s upcoming ban on internal combustion engines (ICE). However, they now face the harsh reality that consumers are not turning to electric vehicles as quickly as initially expected.

In a new statement, ACEA’s board of directors pointed out several key factors that have led to the “continued decline” of the electric vehicle market. They highlighted inadequate charging infrastructure, fierce competition in the manufacturing industry, insufficient purchasing and tax incentives, and unstable supply of basic materials as major challenges. In addition, weak overall economic growth and low consumer acceptance have further exacerbated these problems, leaving automakers facing uncertainty as they transition to an electric future.

The automakers are concerned that current regulations fail to reflect “profound changes in the geopolitical and economic environment over the past few years.” They believe this oversight is undermining the industry’s competitiveness. In their statement, they stressed that “the automotive industry cannot wait until the review of CO2 regulations in 2026 and 2027.” Instead, they insist that “urgent and meaningful action is needed now” to address these pressing challenges.

In light of this situation, the board of the European Automobile Manufacturers Association (ACEA) advocates for a “short-term relaxation” of the stricter CO2 targets for cars and vans for 2025. They argue that such measures would contribute to a smoother transition to zero-emission transport while safeguarding Europe’s industrial future.

Leave a Reply Cancel reply

You must be logged in to post a comment.