Jump to:

Is your business aligned with India’s ESG wave?

ESG investing (also known as “impact investing”) is on the rise, with global investors putting pressure on companies not only to deliver strong financial returns, but also to act responsibly and ethically to achieve this. This market pressure is further exacerbated by increasing global and local regulatory compliance and disclosure requirements related to environmental, social and governance (ESG).

In response, investors are incorporating ESG elements as part of their investment decisions and due diligence processes. This is especially true for those considering the exciting market opportunities in India. While many are aware that the Indian government aims to attract at least $100 billion in total foreign direct investment (FDI) annually by 2024, they may not be aware that the government has also recently developed a progressive ESG regulatory framework. Therefore, investors need to ride the ESG wave in India and ensure that their ESG programs are strong enough to mitigate risks and realize opportunities.

Unraveling the complexities of India’s ESG regulatory framework

In 2014, India became the first country to make corporate social responsibility (CSR) requirements mandatory.1 India is also gradually introducing ESG obligations through its ESG regulatory framework, which covers multiple laws and industry-specific regulations, with multiple agencies responsible for overseeing compliance. Therefore, multinational companies wishing to do business in India need to consider the unique legal and regulatory requirements associated with the Indian market.

While India has made significant progress in aligning its ESG regulations with global standards, India’s comprehensive but fragmented ESG regulatory framework makes it a legal minefield for businesses. Companies are advised to consider industry-specific nuances to ensure compliance with all aspects of applicable legislation.

— Mini vandePol, Head of Investigations, Compliance and Ethics Group, Asia Pacific

Establishing an effective corporate governance (“G”) framework for India

Existing global corporate governance frameworks must be adapted to align with Indian requirements, which vary by industry sector, material ESG considerations and management expertise.

Due to cultural differences between states and union territories, the specific location of operations within India is also an important factor when considering board and committee composition. Furthermore, to ensure compliance with India’s unique CSR regime, eligible companies are required to establish a CSR committee at the place of business.

Potential Impact of Enforcement Trends

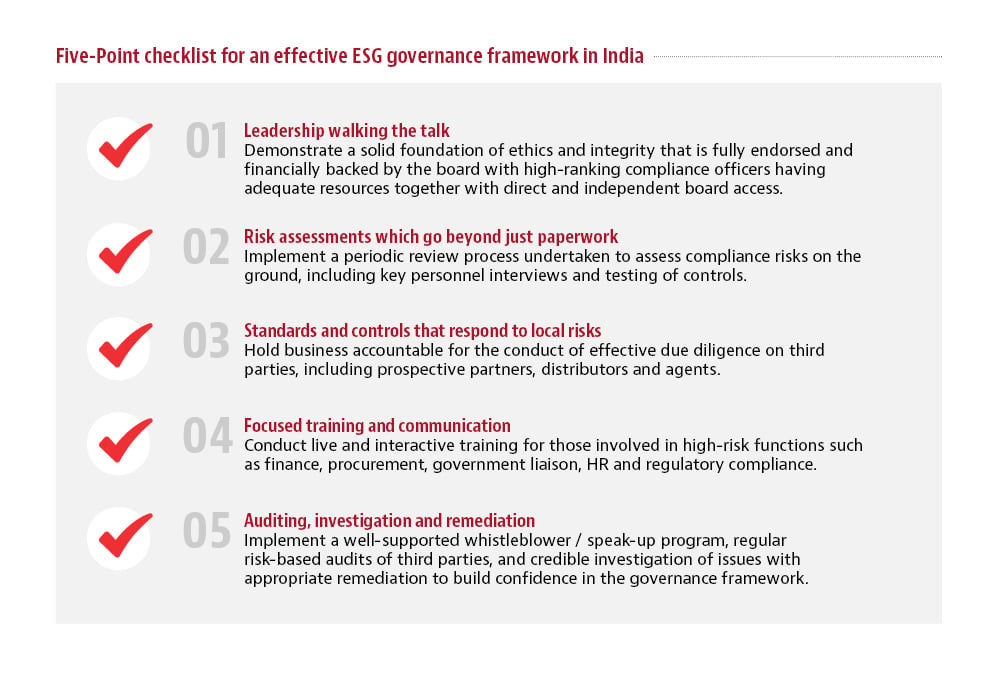

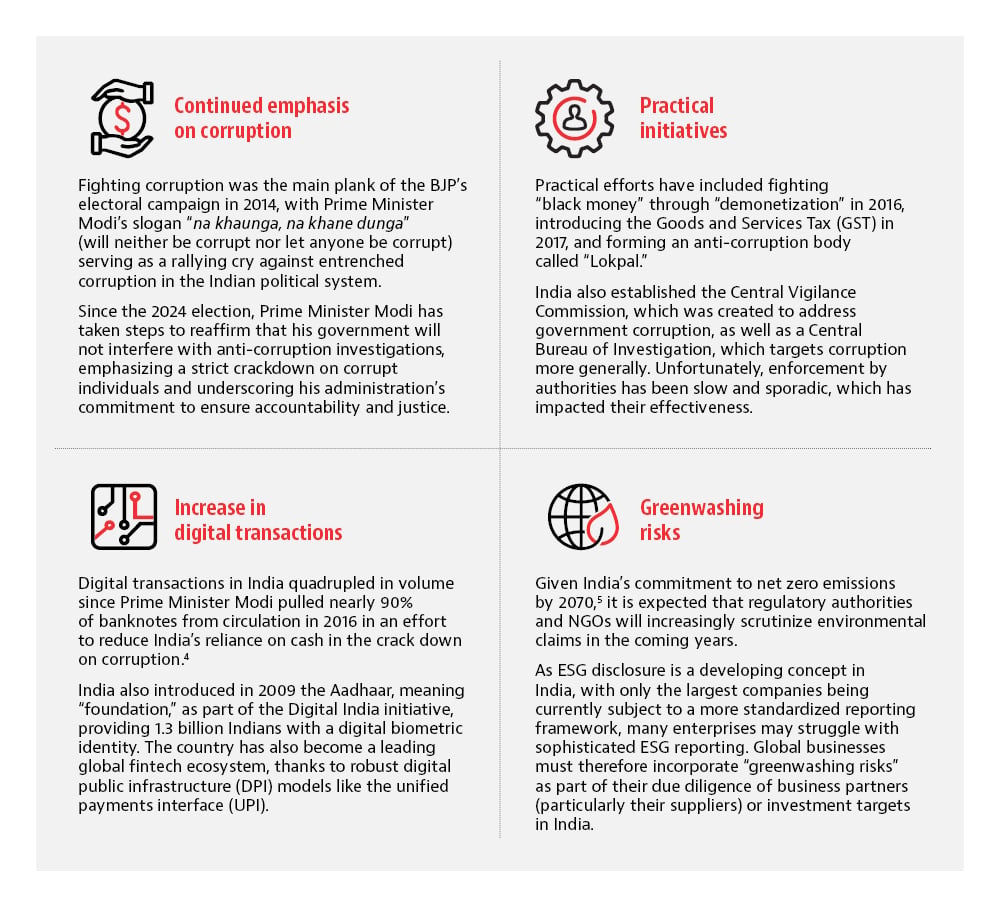

An effective ESG governance framework requires regular monitoring and improvement. Paying close attention to local enforcement priorities and trends is an important part of knowing how to keep the program relevant and useful. There are many enforcement agencies in India, including the Ministry of Corporate Affairs (MCA), SEBI and RBI.

Global businesses may also face challenges when dealing with local law enforcement agencies to ensure ESG compliance. For example, while there is a Central Pollution Control Board (CPCB), enforcement of environmental laws is devolved to State Pollution Control Boards (SPCBs) or pollution control boards in union territories. This type of decentralization can lead to inconsistent application of rules and transparency issues.

— Christine Cuthbert, Partner, Hong Kong

Explore enforcement trends and their potential impact on ESG governance in India:

ESG governance in India requires tailored governance, careful oversight and active engagement with local authorities. Success depends on understanding regional nuances and fostering transparent, ethical practices in all operations.

— Mini vandePol, Head of Investigations, Compliance and Ethics Group, Asia Pacific

Main points

Integrating ESG into India’s core strategy: Global companies must consider ESG risks when formulating growth strategies and executing business decisions. This includes regular training and on-site audits with local partners, promoting compliance with stricter Indian ESG disclosure requirements, and building sustainable supply chains.

Climate change and environmental risks must always be at the forefront: India’s growing role in multinational companies’ manufacturing and supply chains, and the country’s vulnerability to the impacts of climate change, means that climate change and environmental risks are now more visible and may increasingly impact companies’ global disclosures and compliance regulatory requirements.

Addressing increasing regulation of ESG-related reporting and climate risk management: A holistic approach to applicable disclosure frameworks (e.g., International Sustainability Standards Board (ISSB), US Securities and Exchange Commission, and European Corporate Sustainability Reporting Directive (CSRD) climate disclosure approaches) and other ESG disclosures that require the development of governance and social factors requirements to effectively track and monitor risks.

footnote:

1.ICOR 2023 Report

2.SEBI BRSR core framework

3. SEBI ESG Investment Mutual Fund Scheme

4. Corruption Perception Index 2023

5. UNDP India’s Climate Commitment

This article is provided as general information and does not constitute legal advice. Baker McKenzie does not practice Indian law and if Indian legal advice is required we work closely with top Indian qualified lawyers. We would be happy to discuss your needs in India. For more information please contact Ashok Lalwani and Mini vandePol.

Leave a Reply Cancel reply

You must be logged in to post a comment.