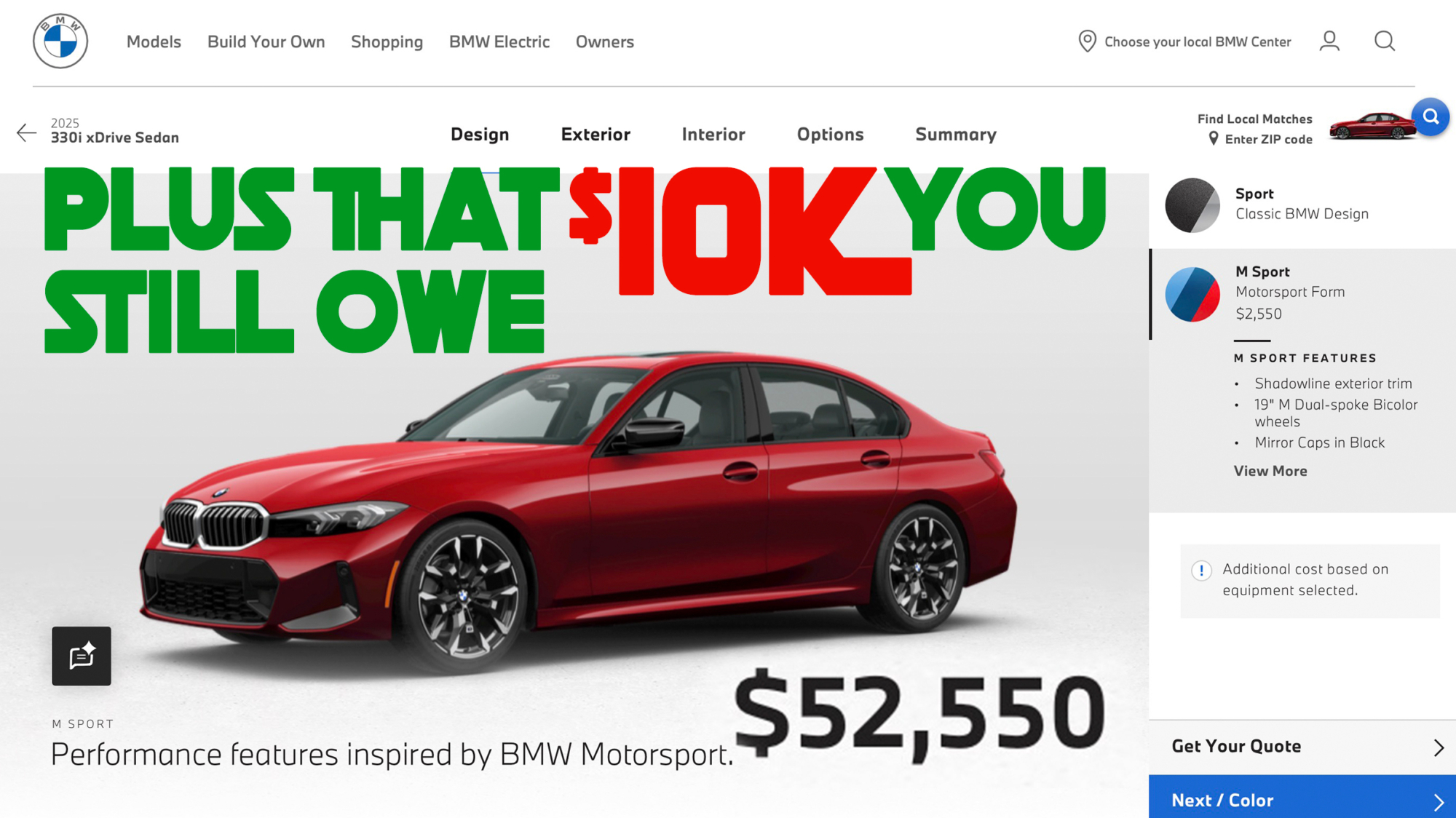

Nearly 25% of borrowers with negative equity owe more than $10,000 on their loans

10 hours ago

- The average ownership level for an Upside Down car loan is at an all-time high.

- One in four trade-ins is underwater, compared with one in five in the third quarter of 2023.

- Edmunds reports that one in four businesses with negative equity owes more than $10,000.

Getting a brand new (or new to you) car is a great feeling. It’s not a good thing to find out that you owe more on your old car loan than the vehicle is worth when you trade it in at your local dealership. This is all too common, and the losses people are sustaining are at an all-time high.

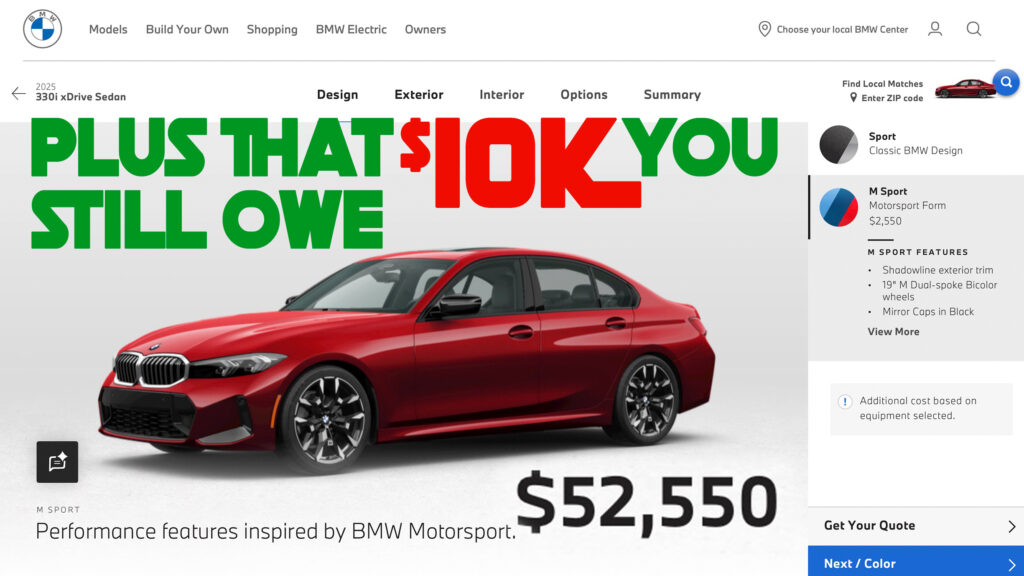

An Edmunds study showed that a quarter (24.9%) of trade-ins were underwater in the fourth quarter, an increase from 24.2% in the third quarter and 20.4% in the fourth quarter of 2023. While it’s not the worst the industry has seen, the amount owed on these loans is at record levels.

RELATED: New car buyers are paying more than $1,000 a month at an alarming rate

The average gap between loan arrears and new car values in the fourth quarter was $6,838, beating the previous quarter’s record of $6,458 and significantly higher than the $6,054 in the fourth quarter of 2023.

things are actually worse

But it gets worse because that’s just an average figure, which means many people owe much more. One-quarter (24.6%) of drivers who found themselves in negative equity when they traded in their vehicles owed $10,000 or more on their loans, an increase from 22.2% in the third quarter. 8.5% owed the dreaded $15,000 in the last quarter, compared with 7.5% in the previous three months.

Assuming these drivers choose to continue upgrading their cars, they will have to pay off the outstanding balance or, more likely, roll the negative equity into a new car loan. Edmunds data shows that a buyer with negative equity would have to make an additional $159 in monthly car payments and take on an additional $12,388 in financing after interest.

Negative equity data for the fourth quarter of 2024

You should do a better job of holding on to what you have

Is it really worth getting yourself into more trouble for a car that might have more gadgets but basically does the same thing as the car you’re currently in? We don’t think so, and neither does Edmonds.

“The consequences of trading in a new car far below sea level can be severe and lead to a cycle of poor car financing decisions,” said Ivan Drury, director of insights at Edmunds.

“If you find yourself significantly underfunded, your best chance of surfacing is to keep the vehicle while keeping up with payments and maintenance.”

Leave a Reply Cancel reply

You must be logged in to post a comment.