In-house processing in a continuous production process is

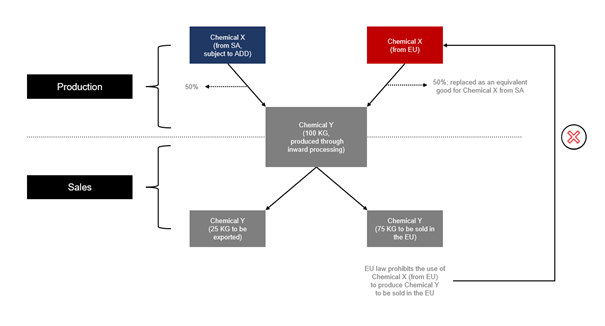

Companies engaged in continuous production processes may face challenges when using EU inbound processing procedures. For context, inward processing allows EU companies to import materials and, if products made from those imported materials are exported, avoid paying import duties and other charges such as anti-dumping and countervailing duties. First, EU customs law allows companies to use inbound processing if the imported non-EU materials used in production can be identified in the products produced. Companies with so-called continuous production processes often find it difficult to identify non-EU materials in the products they produce. For example, if a company sources chemical X in the EU and the United States and mixes them together in a continuous production process to produce chemical proportion. Y. Secondly, EU customs law allows for the so-called principle of equivalence to import processing. This means that non-EU goods can be substituted with the same (equivalent) material as EU goods. However, the law does not allow equivalence if (1)…

EU starts automatically registering product imports

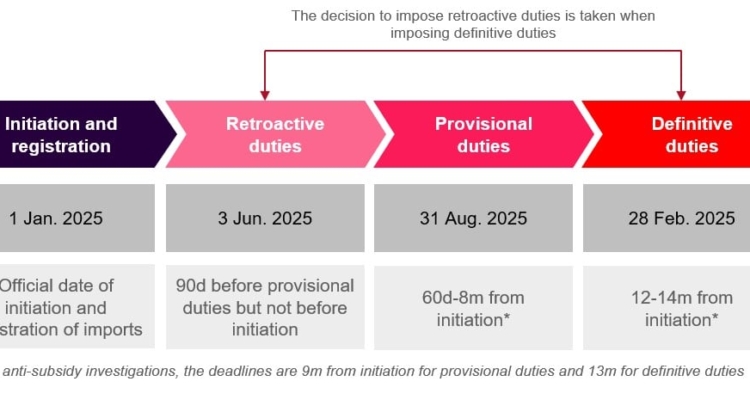

On September 24, the European Commission ("committee”) announced that, as a general policy measure, it would initiate automatic registration of imported products subject to anti-dumping and countervailing investigations (including ongoing investigations). To date, complainants have had to ask the Commission to rely on inventory evidence (i.e. Evidence of increased imports during the investigation) Registering imports. On October 24, the European Commission issued several regulations to register imports in virtually all ongoing anti-dumping and countervailing investigations. Although registration is a purely administrative step taken by EU customs authorities, it is a necessary first step towards the possible retroactive imposition of anti-dumping or countervailing duties. Anti-dumping and countervailing duties can be imposed retroactively for a period of up to 90 days from the date the Commission imposes the provisional duties. In order to impose retrospective duties, the Commission must demonstrate that EU imports of the products in question increased significantly during the period of investigation, which could undermine the remedial effect of…

EU: Evading anti-dumping duties – EPPO seeks jail time

On September 17, 2024, the European Prosecutor's Office (EPPO), the EU agency responsible for prosecuting financial crimes affecting the EU budget, announced that it was seeking criminal penalties of more than 8 years in prison and more than 8 years of imprisonment for two companies and their five directors. Fine of €25 million. More than 30 properties related to the defendants were seized to ensure that the defendants could meet their financial obligations. EPPO alleged that the defendants falsely declared steel plates imported from China that were subject to anti-dumping duties as imported slabs, while the slabs were semi-finished products that were not subject to anti-dumping duties. Although details of the case remain scarce, the EPPO has been stepping up enforcement activities, often working closely with the European Anti-Fraud Office (OLAF) and EU member state customs authorities. One in ten EPPO cases (ie approximately 100 cases per year) involves customs and anti-dumping fraud. In previous articles we warned of the…