Cameron Smith and Mark Smith

Meeting and event planners have reason to be optimistic about their business prospects in 2025: Overall attendance has reached 90% of pre-pandemic levels, according to one leading index. Even better, 81% will have an in-person component and 63% will be fully in-person.

But even so, planners shouldn’t get too comfortable. The business of hosting meetings or events is still a risky business. It’s not just acts of God—like weather instability and natural disasters—that can wreak havoc on the best laid plans. Violence — think active shooter incidents — can expose event sponsors and venue owners to costly injury and wrongful death claims.

Risks remain and need to be adequately measured by insurance policies, which should temper the industry’s enthusiasm for the post-pandemic climate. Special event and entertainment venue insurance may be helpful. Understanding the ins and outs is crucial.

The event cannot continue without special coverage

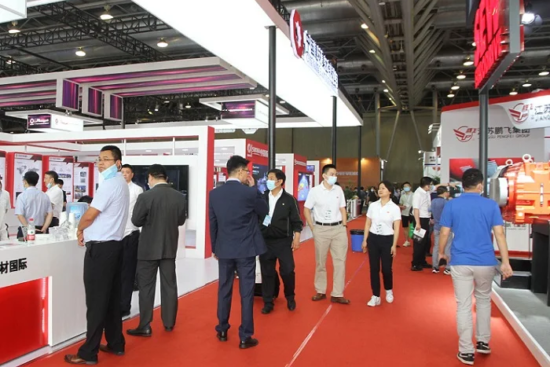

Special event policies can be thought of as peace of mind policies, protecting venues and event sponsors from third-party liability, such as personal injury and property damage. Every type of special event deserves this kind of coverage, whether it’s a business meeting or a trade show, a political rally or a wedding. The venue will need it.

The contract requirements of the venue determine the premium. Any coverage above the typical $5 million coverage limit (also specified by contract) must be approved by a senior underwriter.

Event insurance is both specialized and transactional, and not every broker is familiar with the specifics of writing a policy. Three areas that require special attention include:

- Deductible. It stands to reason that the higher the deductible, the lower the premium. But what matters is the degree of risk and liability, which depends on the nature of the incident. While weddings are lower risk and require a zero deductible, gatherings featuring high-profile or polarizing individuals are higher risk and may have deductibles in excess of $5,000.

- Underwriting Requirements. These can be written into the contract to make certain types of risks eligible for coverage. For example, rock concerts typically require one security guard for every 100 attendees. Amateur sporting events must enter into a harmless agreement. Such measures must be accompanied by written confirmation.

- Exclusions. Activities typically excluded from coverage include hazards that do not apply to most special activities, such as fireworks, firearms, stun guns and knives, aerial maneuvers such as bungee jumping and skydiving, and COVID-19 and other communicable diseases.

Live events return, but entertainment venues at risk

Event sponsors also need to be aware of potential budget pressures as venues scramble to cover the costs of rising insurance rates. Especially with the rise in high-dollar injury claims following violent incidents, insurance companies are less eager to cover entertainment risks as venues pay more for property, general liability, event cancellations and workers’ compensation.

Venues should be mindful of strategies that allow them to obtain adequate coverage affordably. Additionally, meeting planners should understand how these strategies may impact their plans.

Understand and assess the changing nature of recreational risks. The frequency and severity of violence claims may lead venues to reconsider the types of entertainment events they host and reject planners with poor records.

safety role

Robust contingency plans and safety measures must be in place to demonstrate to insurers their role in reducing incident risk. Insurance companies won’t consider venues that cut corners.

Additionally, the supplier must have proof of insurance and be added to the policy as an additional insured.

Details matter. Underwriters require knowledge of the specifics of venue operations, what types of events are being held, and best event management practices being followed. Failure to provide details may result in policy cancellation or overpriced policies, which may be passed on to you.

Cameron Smith is senior vice president at Hub International, a global insurance brokerage. Mark Smith is the company’s marketing director.

Leave a Reply Cancel reply

You must be logged in to post a comment.