By Kali Kaufman

In The Matrix, a computer hacker named Neo takes a red pill and unlocks a hidden world – one where he has powerful superpowers and insights into the nature of reality.

Unfortunately, when it comes to trade compliance, there is no magic red pill.

But if you want to know the truth, you need to crack the code. Specifically, the HTS code of your product.

What is an HTS code?

HTS codes, or Harmonized Tariff Schedule codes, are an important tool in world trade and international trade. They are derived from the Harmonized Tariff Schedule (HS) developed by the World Customs Organization (WCO) and used by most countries to classify goods.

HS Code is a standardized classification system for imported and exported goods. It is a six-digit code, with the first two digits representing the chapter, the middle two digits representing the title, and the last two digits representing the subtitle.

These codes are nearly universal; however, classification may vary from country to country and requires detailed knowledge of the goods in question. It is important to remember that HTS codes are critical to trade compliance, and there are several common HTS classification errors to watch out for.

From electronics to textiles, these codes are essential for processing the complexities of global trade.

In the United States, we use the Harmonized Tariff Schedule of the United States (HTSUS) and classify imported and exported products according to the Harmonized Tariff Schedule (HTS code). The HTS code is a ten-digit code.

The first six digits are the same as the HS code, the next two digits (7th and 8th) provide the US sub-heading and tariff rate, and the last four and two digits are the statistical suffix.

In the bulk of this article, we will delve into the origin, purpose, and meaning of error codes and provide a step-by-step process to accurately identify them to help businesses conduct their trading activities.

Where do they come from? Origin of HTS codes.

“They’re from outer space!” Although the HTS code may seem otherworldly, the HTSUS actually came from Congress. In 1989, to be exact. (The same year Nintendo introduced the Game Boy and Koosh Balls.)

Congress replaced the previous U.S. tariff schedule, bringing standardization to internationally traded goods.

The HTS codes are established and maintained by the United States International Trade Commission (USITC) and are derived from the internationally harmonized system published by the World Customs Organization.

The U.S. International Trade Commission is responsible for maintaining and publishing the HTSUS, while U.S. Customs and Border Protection (CBP) is responsible for interpreting and enforcing the document.

What is the purpose of the HTS code?

HTS codes play a vital role in classifying goods for customs purposes, assisting in import classification and determining tariffs.

They facilitate international trade by providing standardized commodity classification and statistical analysis systems, ensuring transactions run smoothly and comply with regulatory requirements.

Impact of recent changes to HTS codes

In 2023 alone, the HTSUS was revised 11 times. Each revision provides an opportunity for changes to HTS codes, which can affect tariffs and tax rates on goods.

In addition, the World Customs Organization regularly reviews and updates the Harmonized System, which results in changes throughout the HTSUS and often creates entirely new categories, potentially changing the entire commodity classification system.

For example, in the latest HS update incorporated into the HTSUS in 2022, a whole new category for 3D printers is the addition of the last two digits, which changes its classification from heading 8479 to 8485.

Importers must stay informed of these revisions to ensure compliance and may need to review their classification processes to ensure they are providing the correct codes.

How can an incorrect HTS code affect your business?

Incorrect HTS classification and product classification codes can create significant risks for businesses. CBP has the authority to request additional information and reclassify imports until its entry is cleared, a process that can take approximately three years.

This could significantly increase the landed cost of these goods many years after they are imported.

For example, Export Solutions recently assisted a client who received a CF28 Request for Information and a CF29 Notice of Action. These actions by CBP would result in a duty rate of approximately 2.5 times the original entry rate for the product.

After researching and classifying the product, our team determined that the product was classified differently than what CBP recommended. The correct classification would only result in a slight increase in tariffs, saving the client thousands of dollars in future import duties.

Misclassification can also result in the detention of imported goods, delays in the import process, and potentially costly inspections and audits of past entry by U.S. Customs and Border Protection.

In addition to simply increasing tariff rates, customs authorities can also impose fines and penalties for misclassification.

Step-by-step instructions: How to find your HTS code

Before you figure out how to identify the correct HTS code for your product, you must understand how HTSUS works. You can find the latest version of HTSUS on the official USITC website.

HTSUS covers 22 parts and 99 chapters, classifying various commodities.

Each part and chapter is accompanied by section and chapter notes, which are legal texts that specify additional information about which products can or cannot be classified within them.

There are three chapters in the HTSUS that are different from the others: Chapter 77 is currently unused and designated for future use, and Chapters 98 and 99 are reserved for trade remedies, where additional duties or exceptions to tariff rates on certain products are typically found.

(In other words, your product is most likely not in one of these chapters, so there are only 96 chapters left! Happy reading.)

In addition, the HTS contains General Rules of Interpretation (GRI), General Notes, General Statistical Notes and Other Guidance, which contain additional descriptions and explanations that are critical to the classification of goods and understanding of tariff rates.

Understanding the GRI and its general principles, sections, sub-headings and statistical notes can be challenging. Fear not! Export Solutions can help you resolve classification issues, giving you peace of mind when importing goods.

As mentioned before, the HTS code is a 10-digit code. Classification is the process of finding the correct 10-digit number for your product using the HS code.

Let’s go through this step by step with an example. How about a powder blush imported from Korea? Sounds good? Let’s get started:

Step 1: Find the right chapter

First, we need to find the correct chapter for powder blush.

Blush is a cosmetic product. Starting from the HTSUS catalog, we see that Chapter 33 covers “Essential oils and resins; perfumes, cosmetics or toiletry articles,” so we will most likely find the correct HTS code in Chapter 33.

Please note that GRI 1 means that chapter and section headings are provided for ease of reference and therefore they are not legally binding as headings, but they can be used to narrow your search.

Step 2: Get the title

Like a ship lost at sea, without the correct course we will never reach the port.

Our next step is to find a title that describes the powder blush. You should read through the titles until you find the one that best describes your product.

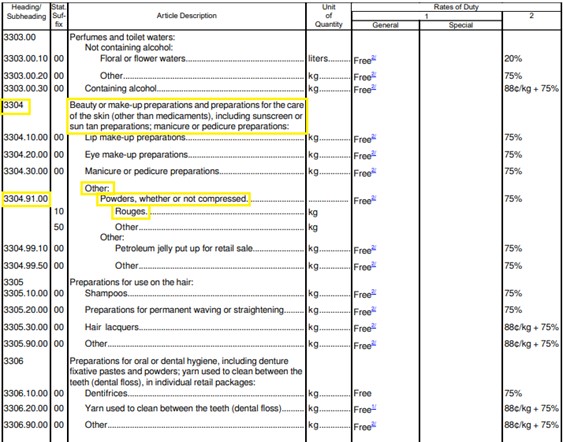

While blush also doesn’t get a special description, we find that heading 3304 is described as: “Cosmetic or make-up preparations and skin care preparations (other than medicaments), including sunscreens or sunscreen preparations; manicure or pedicure preparations.”

It looks like this:

Therefore, we can conclude that “blush” falls under heading 3304 and is a type of cosmetic product.

Although blush is a relatively easy product to find a title for, some products may be described by more than one title.

You should always check the chapter notes for exclusions and definitions. This is where really understanding these GRIs comes in handy.

Step 3: Go to the subheading

We are getting closer. Next, we need to find the subtitle and/or US subtitle.

Again, we need to read through the descriptive text of the next indented subheading. Blush is not lip or eye makeup, nor is it a preparation for a manicure or pedicure, so it will go into the remaining or basket category of “Other,” which includes all products not specified in the previous subheadings.

When comparing subheadings, you need to compare everything in the first level of indentation, then everything in the second level of indentation, etc. We found the description “Powders, whether or not compressed” under the “Other” subheading 3304.91.00.

This 8-digit HTS code provides our tariff rate (in this case, the product is “duty free” or has a 0% tariff rate).

Step 4: Final Numbers

The last step is to find the first complete 10-digit HTS code, including the statistical suffix. In this case, that would be 3304.91.0010: “Rouges,” since rouge is another word for blush.

The full 10-digit HTS code used to classify powder blush is 3304.91.0010. (You may notice that a period has been added to the HTS code.

They exist only to make the code easier to read by visually breaking it up.) Here is the breakdown:

Useful resources to help find the correct HTS code

If you are unsure how to classify your product, seek guidance from an expert. Export Solutions has decades of experience in classifying products in all sections of HTS.

We can also conduct field investigations and research on GRI and past rulings to ensure your products are correctly classified and you are not overpaying (or underpaying) in duties.

Some other resources and ideas include:

You can find and search HTSUS online at the Harmonized Tariff Schedule (usitc.gov)

You can also search the CBP ruling database for previous decisions through the Customs Ruling Online Search System (CROSS) and use search terms to find your product.

You may request a binding decision from CBP by following the instructions here.

Our team will be happy to assist you with your HTS code

Knowing and accurately determining your HTS code is essential to smooth international trade. If you need assistance, please contact Export Solutions.

Our experts will review your classification free of charge to ensure you are on the right track and provide guidance on the best ways to achieve compliance.

Kali Kaufman is a classification specialist at Export Solutions, a full-service consulting firm specializing in U.S. import and export regulations.

Leave a Reply Cancel reply

You must be logged in to post a comment.