Luxury cars costing more than $80,000 typically account for 4.4% of new car sales, but that share rose to 5.6% in December

January 18, 2025 17:16

- Several brands have reported significant increases in transaction prices over the past year.

- Cadillac saw explosive price increases in December, outpacing most other brands.

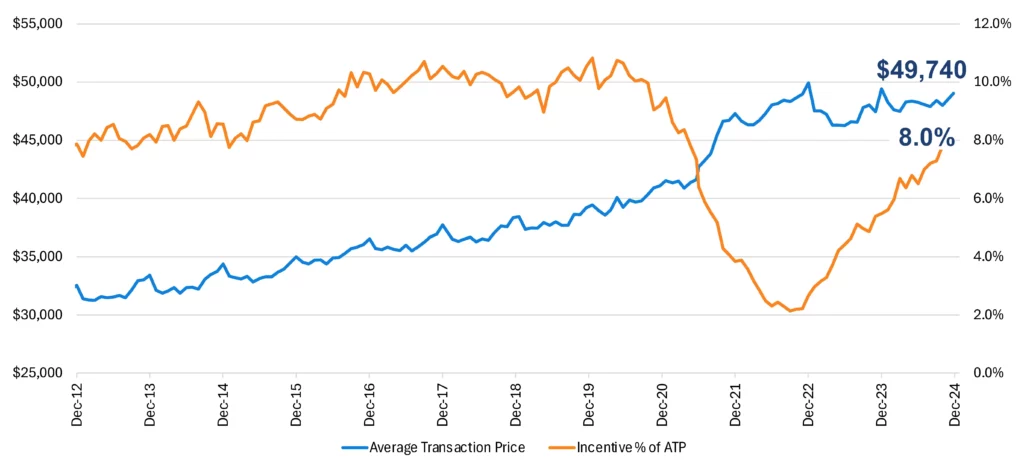

- Incentives remained stable in December, averaging 8% of the average transaction price.

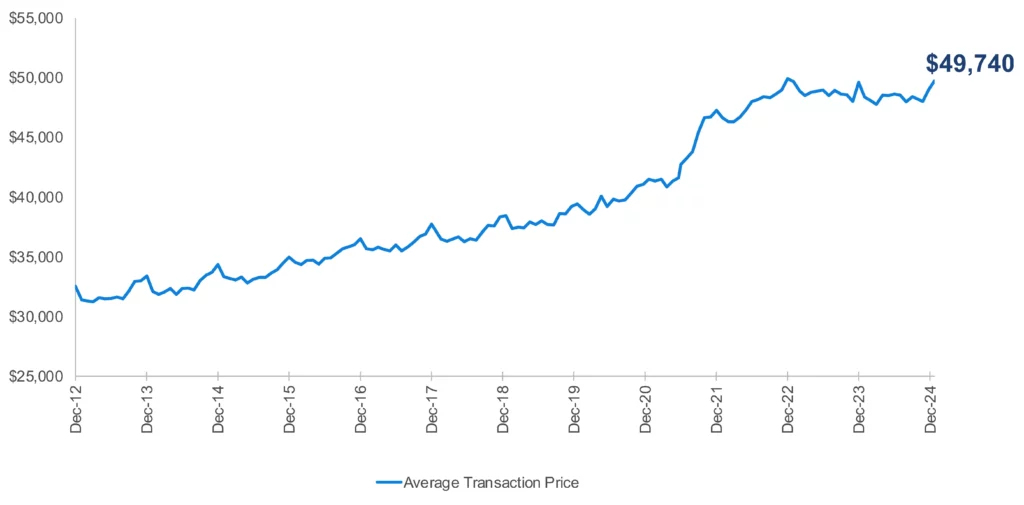

The average transaction price (ATP) of new cars in the U.S. climbed to a near-record high last month, largely due to a surge in luxury car sales in late 2024. Consumer confidence appears to be buoyed by post-election optimism, with buyers flocking to dealerships ready to spend. It will be interesting to see whether this upward trend continues or takes a breather into 2025.

In December 2024, ATP reached $49,740, an increase of 1.5% from $49,010 in November 2024, and a significant increase (+3.4%) from $48,082 in December 2023. The industry-wide record still belongs to December 2022, when ATP reached $49,958 and stock levels began to rebound from the historic lows of the pandemic.

Luxury cars take center stage

A major driver of higher ATP in December was a surge in luxury car sales. According to statistics, typically, cars priced above $80,000 account for 4.4% of the industry’s monthly sales Cox Automotive. Last month, their sales were as high as 5.6%, with about 84,000 luxury models sold. Meanwhile, full-size pickup trucks also played an important role, with an average selling price of $64,261, further boosting overall ATP.

Cadillac reports a big jump in ATP in December. In fact, the average price of a new Cadillac jumped from $67,925 in November 2024 to $79,594. The month-on-month increase was as high as 17.2%. Likewise, Cadillac’s ATP grew 12.8% year over year.

Average transaction price by brand

Several other brands also saw significant price increases. For example, Infiniti’s ATP increased by 4% month-on-month and 8.1% year-on-year. Tesla ATP also increased by 10.5% from December 2023, but remained stable between November and December 2024, although there may be discounts on the soon-to-be-replaced Model Y.

While some luxury automakers celebrated the price increases, not everyone shared in the gains. The average price of Mitsubishi Motors fell by 12.7% year-on-year, Jeep fell by 6.3%, and Buick fell by 7%. Chrysler and Dodge also saw year-over-year declines of 4.3% each.

READ: Average used car price at $25,565, down nearly 3% from 2023

Despite the rising ATP, incentives have remained stable at 8% of the average trading price last month, equivalent to approximately $3,958. However, segment-specific incentives are significantly higher, reaching 10% for entry-level luxury cars, 9.7% for compact SUVs, and 9.4% for luxury compact SUVs.

December results across the automaker group were mixed. General Motors led the gains, rising 3.1% month-on-month, with ATP reaching $54,921, followed by Ford, which rose slightly by 0.3% to $57,134. Stellantis, on the other hand, is having a tough time, with its ATP falling 0.4% on the month and 3.6% year-on-year to $54,822.

Erin Keating, executive analyst at Cox Automotive, summed up December’s sales peak, saying, “This was a December to remember, both in terms of volume and price. As we reported after the election, consumer sentiment and confidence It’s been rising. Cars, especially luxury cars, are often an emotional purchase, and when consumers are optimistic, they go shopping in late 2024. It’s no wonder that rates are slightly lower, discounts are higher, and the glass is still half full. We’re seeing increases in both prices and volumes.”

Looking ahead, all eyes are on 2025 to see if the ATP trend will continue or have peaked. Even the luxury goods market may face a reality check as economic conditions change and a new administration occupies the White House. For now, though, shoppers seem more than happy to treat themselves.

Average transaction price by group

Leave a Reply Cancel reply

You must be logged in to post a comment.