Top 10 best-selling models in Indian two-wheeler market in November 2024, growing and facing challenges – Splendor maintains leadership

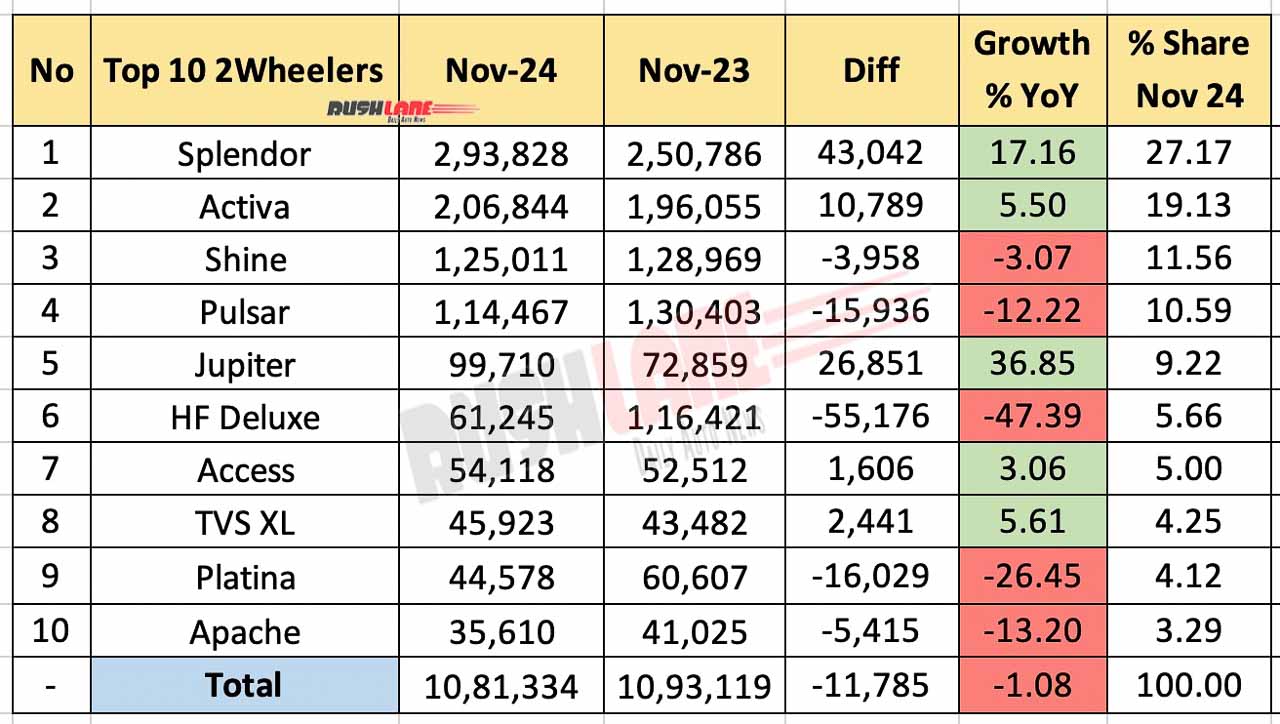

“Heroes” led the market with sales of 2,93,828 units, a year-on-year increase of 17.16%. Honda Activa ranked second with sales of 2,06,844 units, posting a solid growth of 5.50% on the back of its strong appeal among urban commuters. Honda Shine ranked third with sales of 1,25,011 units, but this was a slight decline of 3.07% compared to November 2023.

Top 10 Two-Wheelers in November 2024 – Year-on-Year Comparison

The Bajaj Pulsar, a popular choice in the sports commuter segment, ranked fourth with 1,14,467 units despite a decline of 12.22 per cent. TVS Jupiter emerged as the star performer, ranking fifth with sales of 99,710 units, a growth of 36.85%, driven by its updated features and growing demand. In contrast, Hero HF Deluxe ranked sixth, with sales falling sharply by 47.39% to 61,245 units.

Suzuki Access, ranked seventh, continued to maintain stable performance, selling 54,118 units, achieving a moderate growth of 3.06%. TVS XL is a popular choice in rural and semi-urban markets, ranking eighth with sales of 45,923 units, a sales growth of 5.61%. Bajaj Platina faced a major challenge and ranked ninth with 44,578 units, a significant drop of 26.45%. Finally, TVS Apache, which ranked tenth, recorded sales of 35,610 units, but declined by 13.20%, indicating the increasing competition in the premium commuter segment.

Overall, the top ten two-wheelers recorded a total sales volume of 10,81,334 units, a slight decrease of 1.08% from November 2023. While models such as Splendor, Activa and Jupiter have seen strong growth, others such as HF Deluxe, Pulsar and Platina have faced significant setbacks, highlighting the dynamic and competitive nature of the Indian two-wheeler market.

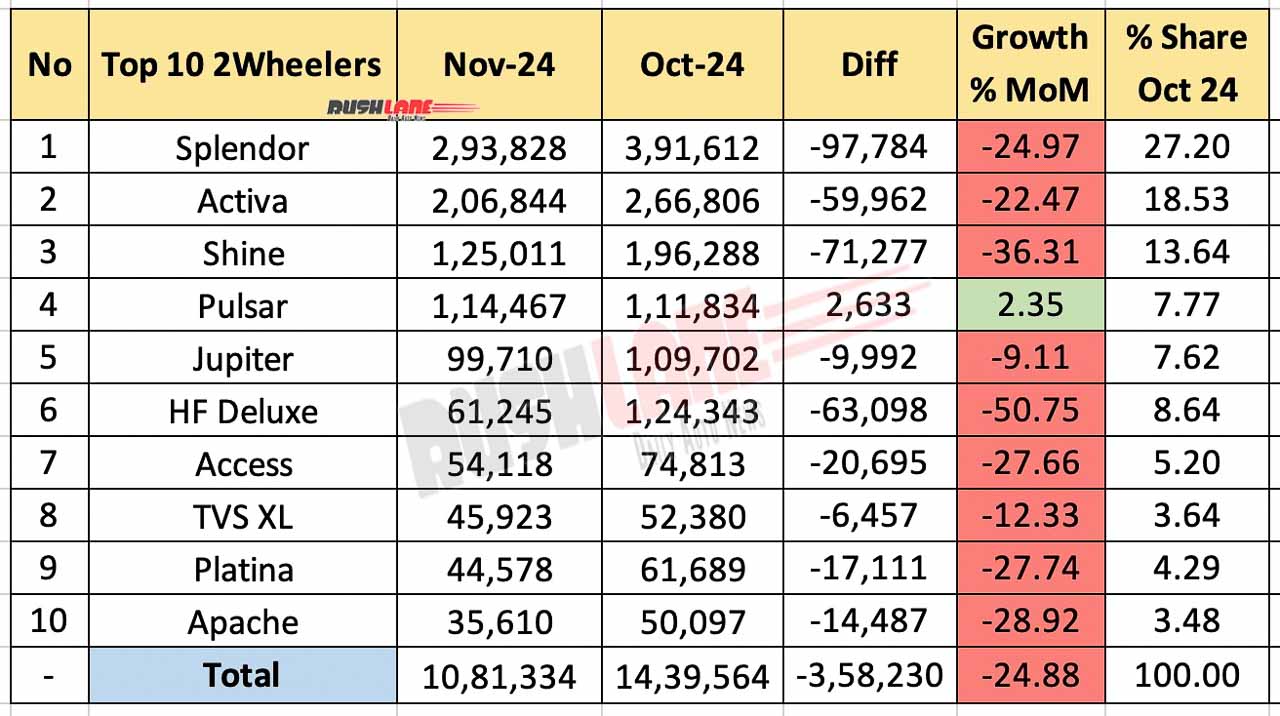

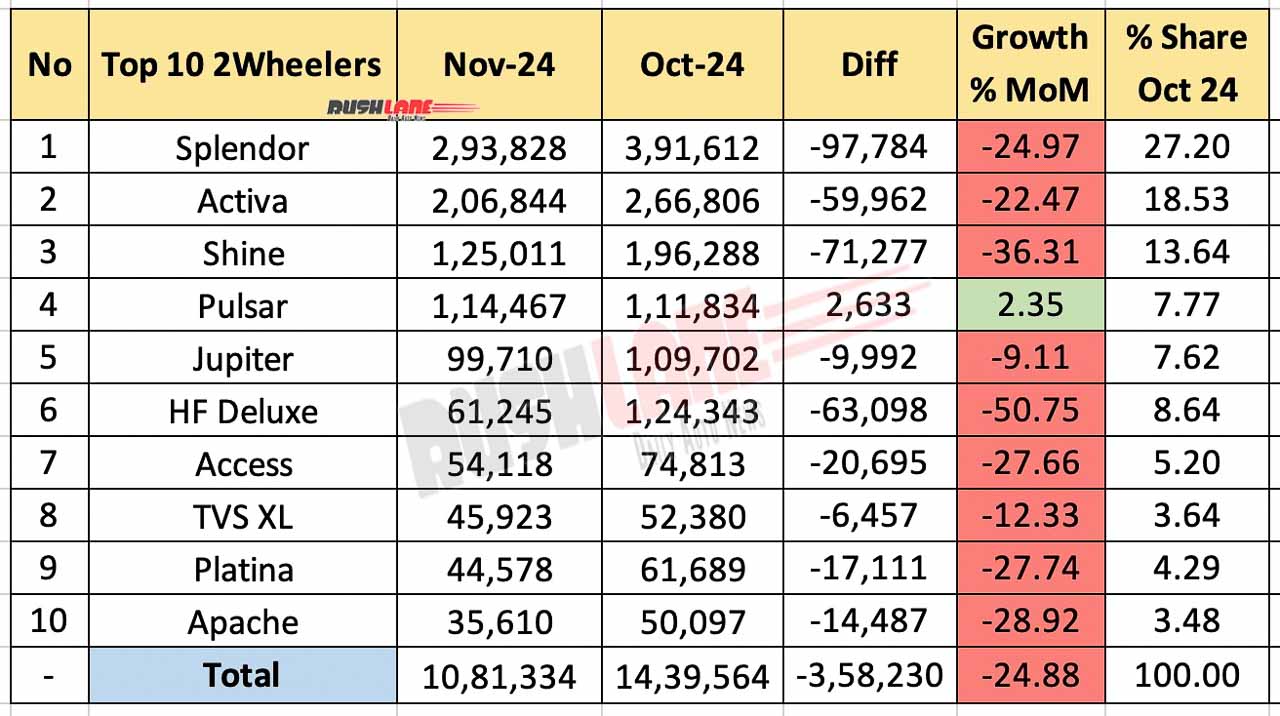

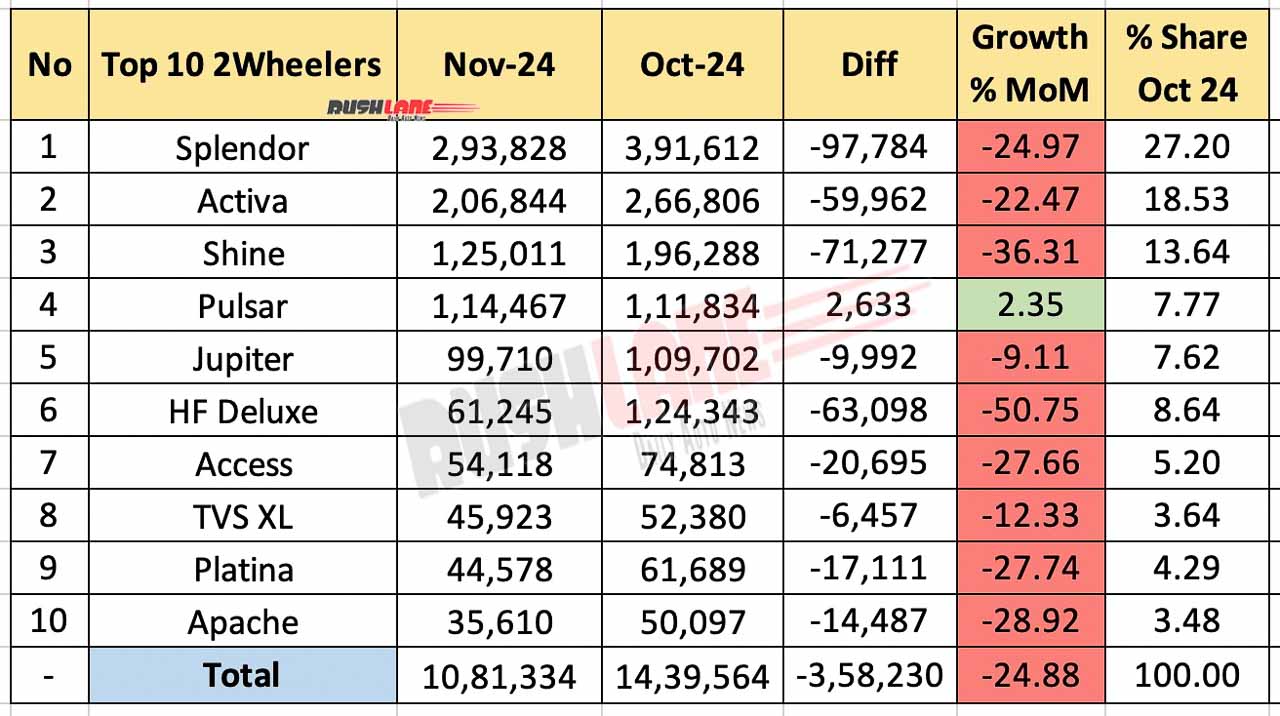

Top 10 Two-Wheelers in November 2024 – Month-on-Month Comparison

In sharp contrast, the month-on-month (MoM) performance from October 2024 to November 2024 showed a sharp decline in sales. The total sales of the top ten two-wheelers fell by 24.88%, with a decrease of 3,58,230 units compared to the festive peak in October. Although Heroes of Glory topped the charts, its sales dropped 24.97%, with 97,784 fewer units sold than in October. Honda Activa also followed a similar trend with a month-on-month decline of 22.47%, with sales falling by 59,962 units. Honda Shine’s decline was the largest among the top three, with a month-on-month drop of 36.31%.

The Bajaj Pulsar emerged as the only model to register monthly growth, with sales increasing by 2.35% to 1,14,467 units. TVS Jupiter fell 9.11% quarter-on-quarter despite strong year-on-year growth. Hero HF Deluxe saw the largest month-on-month decline with sales down 50.75%, followed by Suzuki Access (down 27.66%) and Bajaj Platina (down 27.74%). TVS XL and Apache also experienced month-on-month declines of 12.33% and 28.92% respectively.

The sharp sequential decline can be attributed to post-holiday adjustments and seasonal market trends, with consumers buying ahead of the October festive season. While the year-on-year figures highlight the long-term growth of models such as Splendor, Activa and Jupiter, the month-on-month performance reflects the cyclical nature of the Indian two-wheeler market.

Leave a Reply Cancel reply

You must be logged in to post a comment.