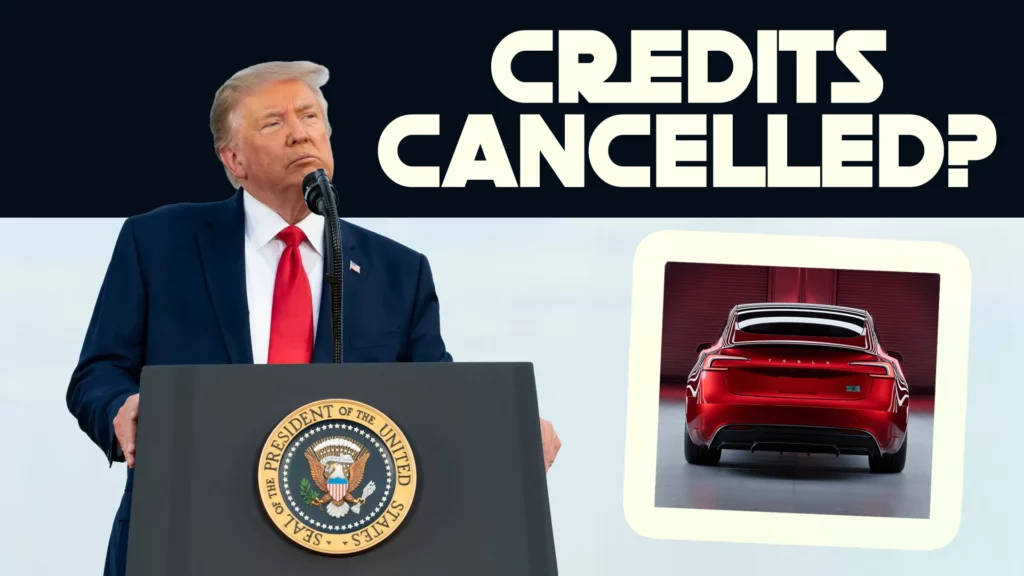

- A new report suggests President Trump will try to eliminate the $7,500 electric vehicle tax credit when he returns to the White House next year.

- Tesla, whose CEO Elon Musk is a big supporter of Trump, is said to support the move.

- Eliminating the tax credit could have a devastating impact on electric vehicle sales, automakers and autoworkers.

President-elect Trump is preparing to return to the White House, which means big changes for the auto industry after years of a government-backed electric vehicle push. While specific details remain unclear, it appears the incoming administration wants to end the $7,500 federal tax credit.

var adpushup = window.adpushup = window.adpushup || {que:()}; adpushup.que.push(function() { if (adpushup.config.platform !== “DESKTOP”) { adpushup.triggerAd(“4d84e4c9 -9937-4f84-82c0-c94544ee6f2a”); } else{ adpushup.triggerAd(” 6a782b01-facb-45f3-a88f-ddf1b1f97657″); } });

Reuters cited two people familiar with the matter as saying that Trump’s transition team aims to eliminate the electric vehicle tax credit as part of a larger tax reform plan. Tesla is said to support the move, and it’s clear that CEO Elon Musk supported Trump during the campaign and has Trump’s ear.

More: Trump threatens 200% tariffs on Mexican-made cars

While eliminating the incentive is easier said than done, it took Americans a little more than six months to apply for more than $1 billion in tax credits this year alone. The money has helped consumers get more than 150,000 “clean vehicles,” which the government says will save them about $1,750 a year in fuel and maintenance costs.

var adpushup = window.adpushup = window.adpushup || {que:()}; adpushup.que.push(function() { if (adpushup.config.platform !== “DESKTOP”) { adpushup.triggerAd(“5646c171 -cb6e-4e2c-8440-49013ca72758″); } else { adpushup.triggerAd(” e7c4c913-3924-4b2d-9279-6c00984dd130″); } });

In June, the U.S. Treasury Department and Internal Revenue Service said the new advance tax credit had been used to purchase more than 125,000 new vehicles and more than 25,000 used vehicles. The credit for the former is up to $7,500, while the credit for used cars is up to $4,000.

If those credits end, the appeal of electric cars may suddenly become less appealing. That could be catastrophic for automakers that have invested heavily in electric vehicles and are already facing slower-than-expected adoption. It could also prompt more companies to abandon or delay all-electric plans.

Automakers aren’t the only ones who should be worried, as employees building electric vehicles could find themselves with nothing to do if demand dries up. Ford is close to achieving that goal, as production of the F-150 Lightning will end later this month and won’t resume until 2025.

Won’t this hurt Tesla?

One might think Tesla and its bosses would oppose eliminating the federal EV credit. After all, the company has historically benefited from such incentives. But in true Elon Musk fashion, the story is rarely that simple.

During an investor call in July, when asked whether repealing the Inflation Reduction Act (IRA) after Trump was elected president would keep him up at night, Musk admitted that losing points to competition from Tesla It would be “devastating” to rivals, but even more so to Tesla itself. In fact, he said such a move could actually benefit his company “in the long run.”

If anything, the mere rumors of points being canceled could spark a frenzy of buyers rushing to buy electric cars before the end of the year (Model Y Juniper updates and their light bars be damned). Since Tesla holds nearly 50% of the electric vehicle market share, it is expected to be the biggest winner in this scenario.

Without those credits, many of Tesla’s competitors, which have invested heavily in electric vehicle development, would be in serious trouble, and some might disappear altogether. Musk seems ready to play the long game.

var adpushup = window.adpushup = window.adpushup || {que:()}; adpushup.que.push(function() { if (adpushup.config.platform !== “DESKTOP”) { adpushup.triggerAd(“e96f0476 -8b1d-4bb8-b64c-33f9656987b2″); } else { adpushup.triggerAd(” 0f9edca9-aa84-4c07-8987-4cad23928c2d”); } });

Leave a Reply Cancel reply

You must be logged in to post a comment.