Policy uncertainty in Europe and the United States has a negative impact on trade: “In a more uncertain environment,” a World Bank report states, “firms may choose to postpone investment and export decisions, and consumers may cut back on spending.”

The latest data from the U.S. Bureau of Economic Analysis (BEA) shows no sudden increase in U.S. consumer spending, supporting the view that the early peak season for container cargo is driven more by frontloading of imports rather than increased consumer demand.

Also read: US consumer spending trends reshape container shipping dynamics

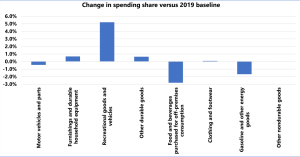

According to Sea-Intelligence, year-over-year growth rates for “durable goods” fell sharply in early 2024, and although they have recovered, they have not yet reached 2023 levels. In contrast, spending on “non-durable goods” has been showing consistent growth since late 2022, but there was no unexpected spike in consumer spending in the late spring and early summer of 2024.

The only significant increase in consumer spending in the “goods” category was in “leisure goods and vehicles”, which jumped from 10.2% in 2019 to 15.1% in June 2024. However, Alan Murphy, CEO of Sea-Intelligence, stressed that this growth was mainly driven by “information processing equipment”, such as “computer software and accessories”, which do not rely on container transportation. Therefore, the increase in consumer spending in this area has not translated into significant growth in the container shipping industry.

Murphy stressed that none of the categories supporting container shipping have seen significant growth recently, suggesting that the rise in container volumes in May and June was primarily due to the frontloading of peak season cargo rather than a true surge in consumer demand. In addition, the U.S. Census Bureau reported that container demand did not surge until spot prices for containers surged.

Leave a Reply Cancel reply

You must be logged in to post a comment.