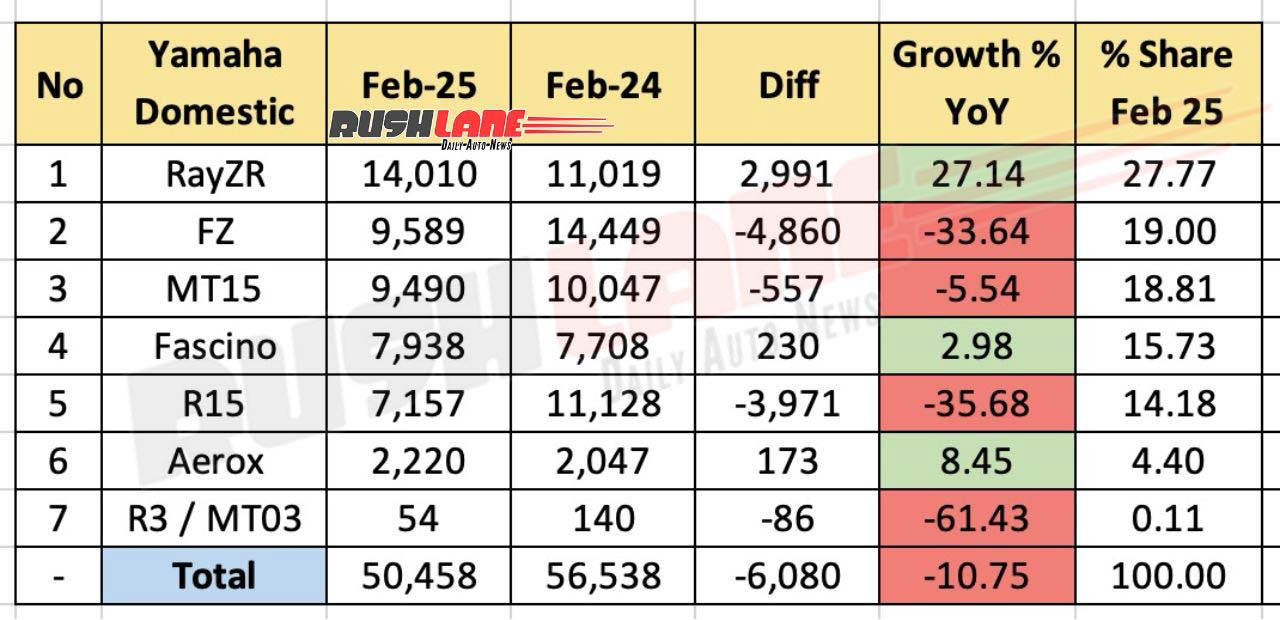

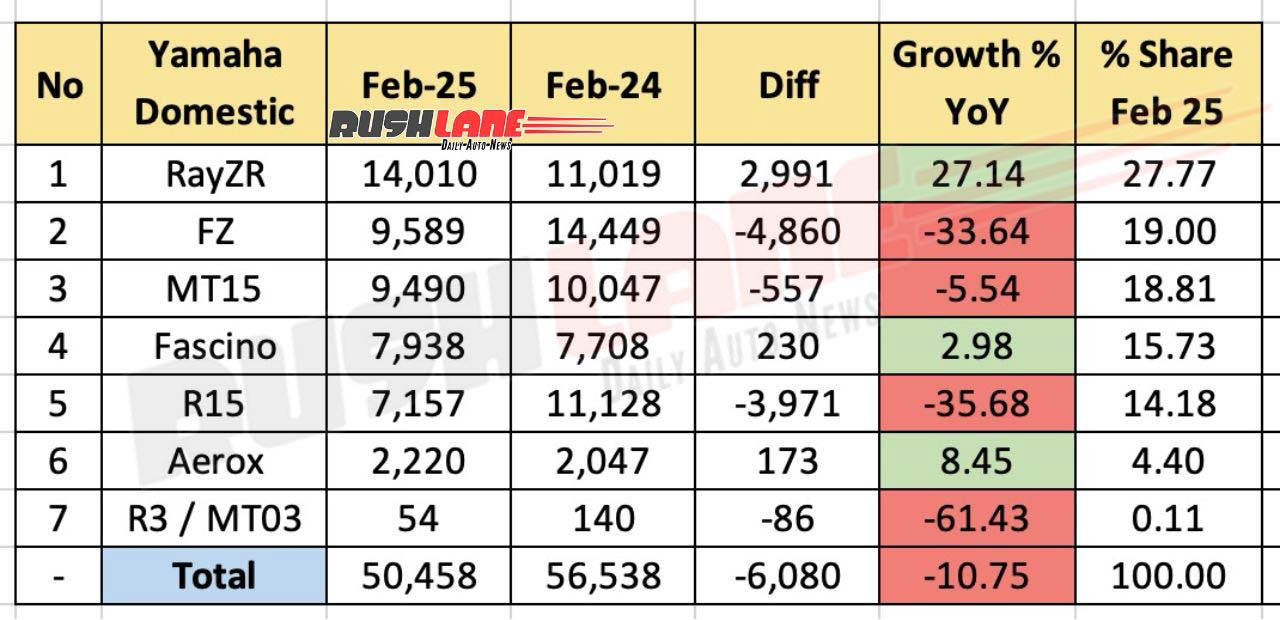

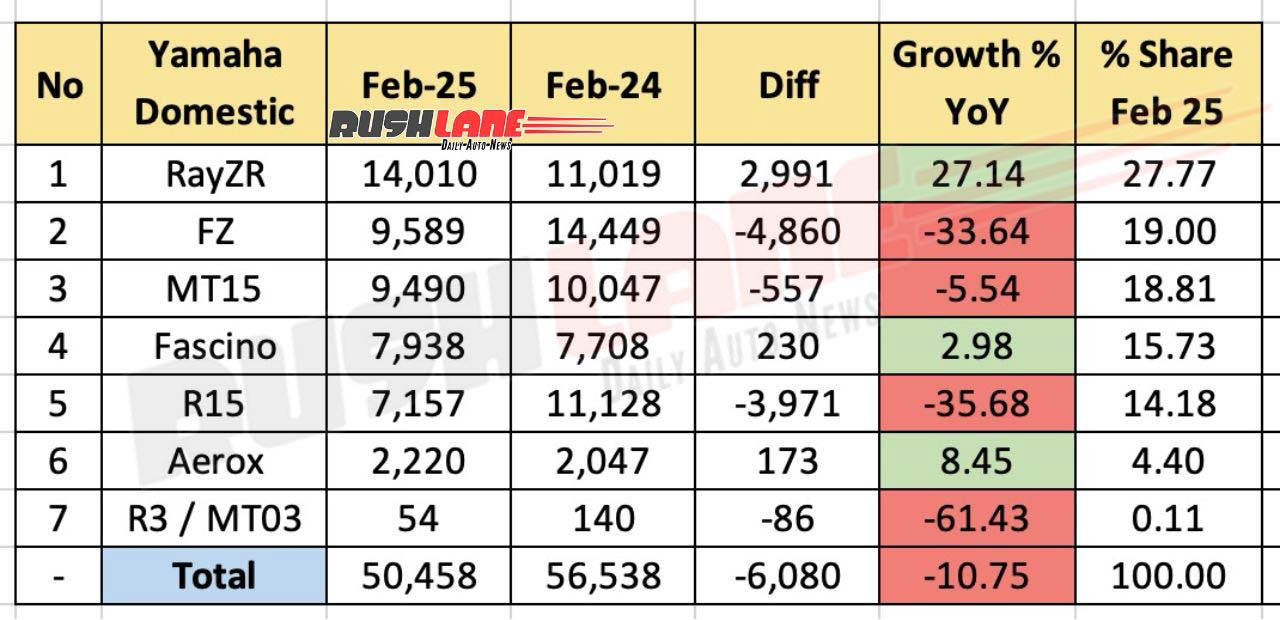

The Blue team closed its February 2025 sales book, and both Yooi and Mom’s side fell by about 10%. Yamaha Motor India sold 50,458 units of motorcycles and scooters in the domestic market in the month of February 2025. When compared to 56,538 units sold in February 2024 and 55,545 units sold in January 2025, Yamaha registered 10.75% YoY and 9.16% MoM decline, losing 6,080 units in volume YoY and 5,087 units MoM.

Yamaha Sales Breakup February 2025

The company’s best-selling Indian market model is still the Rayzr 125 scooter. Yamaha sold 14,010 Rayzr in India, accounting for 27.77% of Yamaha’s total domestic market. By comparison, when 11,019 sold last year and 15,209 sold a month ago were sold, Rayzr’s year-on-year increase of 27.14%, while mom’s declined by 7.88%.

Where the number involved, Rayzr gained 2,991 units, but YOY lost 1,199 units of mom. In second place, we have Yamaha’s evergreen FZ lineup, consisting of multiple variants. Yamaha recently updated its FZ lineup with a new TFT dashboard that comes with music controls and turns through turn navigation.

In terms of sales, FZ took second place with 9,589 units, responsible for 19% of the company’s total sales. The FZ fell completely into red while lowering 33.64% year-on-year and 15.88% mom drops, while 14,449 units and 11,399 units sold at 14,449 units a year ago and a month ago. The associated volume loss was 4,860 units, the same unit and 1,810 units of mothers.

In third place, we have MT-15, premium and high-performance 150cc Street Fighter motorcycles. It sold 9,490 units, accounting for 18.81% of the company’s total sales. Sales fell as MT-15 grew 5.54% year-on-year, while MOM sales fell 10.81%. MT-15 lost 557 units in Yoy and 1,150 units of moms.

R3&MT-03 registered 2,600% MOM growth

The Fascino 125 ranked fourth in Yamaha’s sales list, with 7,938 units sold last month. By comparison, when 7,708 sold last year and 10,640 sold a month ago were sold, Fascino’s year-on-year growth was 2.98% and MOM fell 3.91%. Fascino accounts for 5.73% of Yamaha’s total sales.

Yamaha’s Golden Boy, R15, is a fully covered version of the MT-15 (or the opposite) down 35.68% year-on-year and MOM dropped 13.40% as it sold 7,157 units compared to 7,128 units last year, compared to 11,128 units sold last year, and 8,264 units sold a month ago. In February 2025, R15 accounted for 14.18% of Yamaha’s total sales.

The company’s sport scooter, Aerox 155, managed to sell 2,220 units and is the only product on the list, registering Yoy and Mom growth at 8.45% and 25.42% respectively. Yamaha’s multi-cylinder portfolio (R3 & MT-03) lowered a significant price cut earlier this year, which seemed to have increased sales moms from just 2 units to 54, gaining a 52 unit moms increase.

Leave a Reply Cancel reply

You must be logged in to post a comment.