in short

On 6 November 2024, the Monetary Authority of Singapore (MAS) published its response to feedback on the July 2023 consultation paper setting out a proposed regulatory framework for single-family offices (SFOs) operating in Singapore. SFOs are not required to obtain a license under the Securities and Futures Act 2001 (SFA) and the proposals aim to harmonize standards for a simplified class exemption regime and address potential money laundering (ML) risks posed by SFOs.

You can access our previous reminders about consultations here.

MAS will provide further details on the implementation effective date, the revised legislation and the means of submitting initial notifications and annual returns prior to the implementation of the SFO framework.

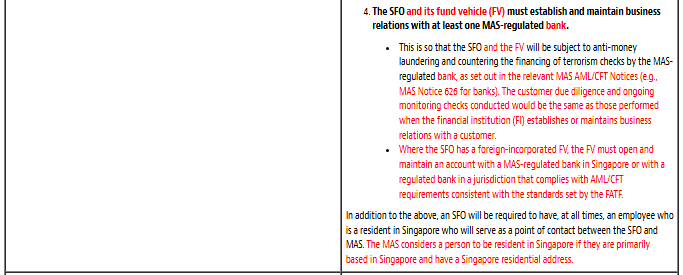

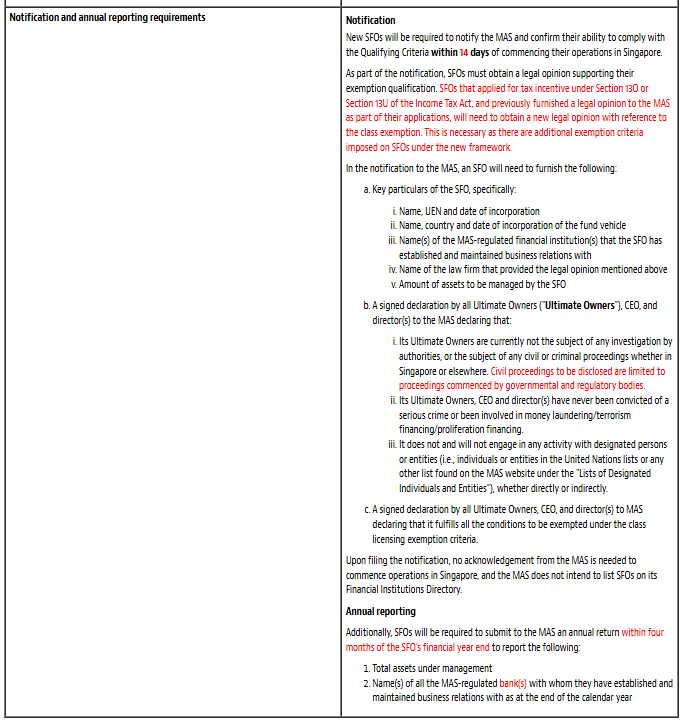

The MAS has provided further details and clarification on key measures to be implemented under the SFO framework. These further details and instructions appear below in red font:

MAS proposes to provide a one-year transition period from the date when the proposed SFO framework comes into effect for all SFOs with existing licensing exemptions to confirm their ability to comply with the new eligibility criteria and notify MAS of this.

Existing licensing exemptions that the SFO has been relying on prior to the implementation of the new SFO framework will be withdrawn upon SFO submitting the necessary notifications to MAS, or at the end of the one-year transition period, whichever is earlier. SFOs that have submitted notifications to MAS can continue to operate in Singapore without obtaining confirmation from MAS. Securities and futures funds that fail to meet the eligibility criteria (and therefore cannot submit a notification) and continue to carry out fund management business after the one-year transition period will be deemed to be in breach of the Securities and Futures Ordinance.

The MAS will provide further details on the implementation effective date, the revised legislation and the manner in which initial notifications and annual returns will be submitted prior to the implementation of the SFO framework.

** ** ** **

If you have any feedback or questions, please feel free to contact us.

© 2024 Baker & McKenzie.Wong & Leow. all rights reserved. Baker & McKenzie.Wong & Leow is a limited liability company and a member firm of Baker & McKenzie International, a global law firm with member firms around the world. Under common terminology used in professional services organizations, a “client” is a partner or equivalent of the law firm. Likewise, references to “offices” shall mean the offices of any such law firm. In some jurisdictions, this may be considered “attorney advertising” requiring notice. Previous results do not guarantee similar results.

Leave a Reply Cancel reply

You must be logged in to post a comment.