Harnessing B2B Payment Transactions: The Market Will Move Beyond the Dollar

introduce B2B (Business-to-Business) payment exchanges refer to the electronic transfer of funds between businesses for settlement of goods, services or other commercial transactions. The market includes multiple payment methods such as wire transfers, ACH (Automated Clearing House) payments, credit cards, and emerging technologies such as blockchain and digital currencies. Also read: It’s time for B2B businesses to accelerate their adoption of digital payments According to a Market.us report, Global B2B payment transaction market Significant growth is expected over the next decade. It is expected to start from $1.4 trillion Expected to be 2023 will reach US$3.5 trillion by 2033, Represents the compound annual growth rate (Compound annual growth rate) is 9.5% Over the forecast period 2024 to 2033. This growth is driven by a variety of factors, including continued digital transformation, increased adoption of advanced payment technologies, and a greater focus on streamlining business-to-business transactions. 2023, North America Dominate the global market, occupying more than 40.9% of total market share.…

The P2P payment market is valued at US$13 trillion

According to a recent report, the P2P payment market is worth US$3.21 trillion in 2023 and is expected to reach US$13 trillion by the end of 2032. global market insights corp.. Driven by the increasing popularity of mobile technology and digital wallets, the P2P payments market size is expected to grow at a compound annual growth rate of more than 15% between 2024 and 2032. As smartphones and internet connections become more common, consumers are increasingly turning to P2P payment apps because of their convenience and ease of use. According to GSMA, by 2023, about 54% of the world's population (equivalent to about 4.3 billion people) will own a smartphone. These payment platforms also allow users to quickly and securely transfer money between accounts, pay for goods and services, and split bills without the need for physical cash or checks. The rise of e-commerce and increasing preference for contactless transactions are driving the market growth. As consumers seek faster and…

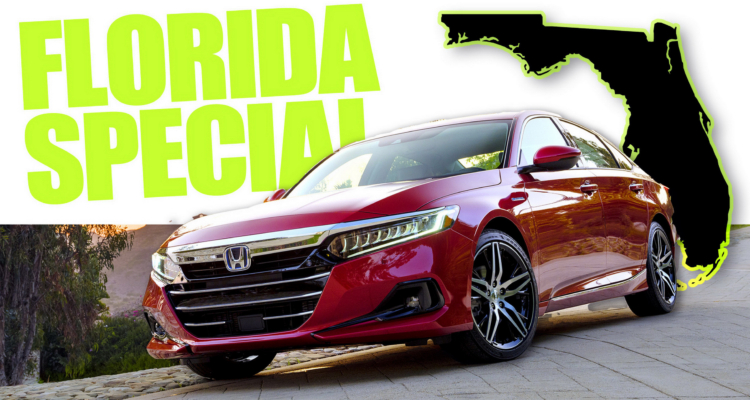

Florida dealer solution for missed payment? carjacker

The employee was part of the dealer's family and threatened customers with a gun October 20, 2024 17:20 An employee of a family-owned Florida dealership has been convicted of carjacking a customer. The incident occurred despite the vehicle owner being on a payment plan. Convicted employees now face up to 15 years in prison if found guilty by a jury. In the world of car dealers, payment disputes are often resolved with a few phone calls to the bank or a pile of paperwork behind closed doors, not with threats and guns on the street. But when tempers flare and judgment fails, things can take a dangerous turn. What was supposed to be a routine incident on a 2020 Honda Accord in Florida turned into a carjacking and a dealership employee is facing jail time. Erik Hadad is a 58-year-old Israeli citizen who works at Guru Auto Sales, a family-owned dealership in Aventura, Florida. According to the U.S. Department of…

Indonesia: Payment System Blueprint 2030 – Indonesia Advances

brief As a sequel to the Payment System Blueprint 2025 (see our November 2019 Client Alert), which has led to the successful implementation of several key initiatives such as (i) continued domestic and cross-border implementation of the Indonesian Quick Response Code Standard (QRIS) (see our August 2019 and September 2022 Client Alerts), (ii) the National Open API Standard (SNAP) (see our August 2021 Client Alert), (iii) Real-time Payment Infrastructure (BI-FAST) and (iv) Regulatory, Licensing and Supervisory Reforms (see our January 2021 Client Alert), Bank Indonesia has now published the Payment System Blueprint 2030 (“2030 Blueprint"). The main objectives of the 2030 Blueprint are to ensure the resilience of payment systems to economic and technological challenges and to integrate the various payment systems to create a more efficient and cohesive structure. Future policies and regulations on interconnection between non-bank institutions and banks, including in the payment field The continued growth and interconnectedness between banks, non-banks (e.g., payment service providers, finance companies,…

Payment card reader integration with online banking

No online banking or transaction is complete without payment cards. The increasing adoption of payment cards across the globe has fueled the payment card reader market. A payment card reader is a device that allows businesses to accept payments from customers using debit cards, credit cards, or even contactless payments through Apple Pay or UPI. It helps businesses process payments quickly, enhance customer experience, and reduce the risk of fraud. It is widely used in industries such as retail, transportation, banking, hospitality, healthcare, and e-commerce. According to a Consegic Business Intelligence report, Payment Card Reader Market The size is expected to increase from US$17,414.53 million in 2023 to US$61,771.27 million in 2031, and is expected to grow by US$20,090.45 million by 2024, at a CAGR of 17.1% between 2024 and 2031. The integration of payment card readers with online banking platforms is a transformative development in the financial sector. It guarantees convenience, security, and efficiency. Also read: Online Banking Trends:…

Payment card reader integration with online banking

No online banking or transaction is complete without payment cards. The increasing adoption of payment cards across the globe has fueled the payment card reader market. A payment card reader is a device that allows businesses to accept payments from customers using debit cards, credit cards, or even contactless payments through Apple Pay or UPI. It helps businesses process payments quickly, enhance customer experience, and reduce the risk of fraud. It is widely used in industries such as retail, transportation, banking, hospitality, healthcare, and e-commerce. According to a Consegic Business Intelligence report, Payment Card Reader Market The size is expected to increase from US$17,414.53 million in 2023 to US$61,771.27 million in 2031, and is expected to grow by US$20,090.45 million by 2024, at a CAGR of 17.1% between 2024 and 2031. The integration of payment card readers with online banking platforms is a transformative development in the financial sector. It guarantees convenience, security, and efficiency. Also read: Online Banking Trends:…

Tesla repair lawsuit moves forward in court

A previously dismissed class-action lawsuit alleged that owners were forced to use Tesla repair centers and parts. July 14, 2024 — A Tesla repair class action lawsuit that was dismissed in November 2023 has been given new life after a judge allowed the plaintiffs to amend and refile the lawsuit. According to the lawsuit, Tesla owners are forced to use Tesla repair facilities and parts, preventing customers from using independent repair shops or parts from non-Tesla companies. Because all electric vehicles are designed differently, the plaintiffs claim that Tesla electric vehicles can only be maintained and repaired by service providers "specializing in the maintenance and repair of Tesla electric vehicles." Tesla repair lawsuits include: “Any person or entity that has paid for Tesla repair services or Tesla-compatible parts in the United States since March 2019.” The Tesla repair and parts class action lawsuit was consolidated from five related class actions, with the current version filed by nine Tesla customers. On…