A new study from Trace One identifies the potential impact of import tariffs and shortages of foreign goods on U.S. food supplies.

Also read: “US importers to face tariffs regardless of election outcome”

Donald Trump’s recent plan to impose 25% tariffs on imports from Mexico and Canada, and an additional 10% on goods from China, could have a significant impact on American consumers. The three countries together supply nearly half (45%) of U.S. food and beverage imports, making everyday staples more vulnerable to rising prices.

Currently, nearly one-fifth of the U.S. food supply is imported from abroad, and the average American household spends nearly 14% of its annual budget on food and beverages. For many, this is already a burden—28% of U.S. adults report difficulty affording food, and 13.5% of households are classified as food insecure, meaning they cannot reliably obtain adequate nutrition.

To better understand the potential impact of import tariffs and shortages of foreign goods on the U.S. food supply, researchers at Trace One, a firm that specializes in regulatory compliance for the food and beverage industry, analyzed data from the U.S. Department of Agriculture, the U.S. Census Bureau, and the U.S. Economy Analysis Bureau. Their focus is to track changes in food imports over time, examine food imports as a percentage of total consumption, identify major trading partners, and highlight each state’s top imported products. For more information about data sources and methods, see the Methods section.

U.S. agricultural products import and export

USDA forecasts agricultural trade deficit to reach $42B in 2025

The United States has traditionally exported more agricultural products than it imported, but that balance has shifted in recent years as imports have grown more than exports. Demand for imported goods has surged, driven by factors including a stronger U.S. dollar and consumer preference for year-round access to fresh produce.

Looking ahead, the USDA predicts that the agricultural trade deficit will reach $42 billion in 2025, which would be the largest deficit on record in at least the past three decades. U.S. agricultural exports are expected to fall to $169.5 billion, down $4 billion from the previous year, due to lower prices for major commodities such as soybeans, corn and cotton and lower beef exports. At the same time, agricultural imports are expected to increase to $212 billion due to increased demand for agricultural products and sugar.

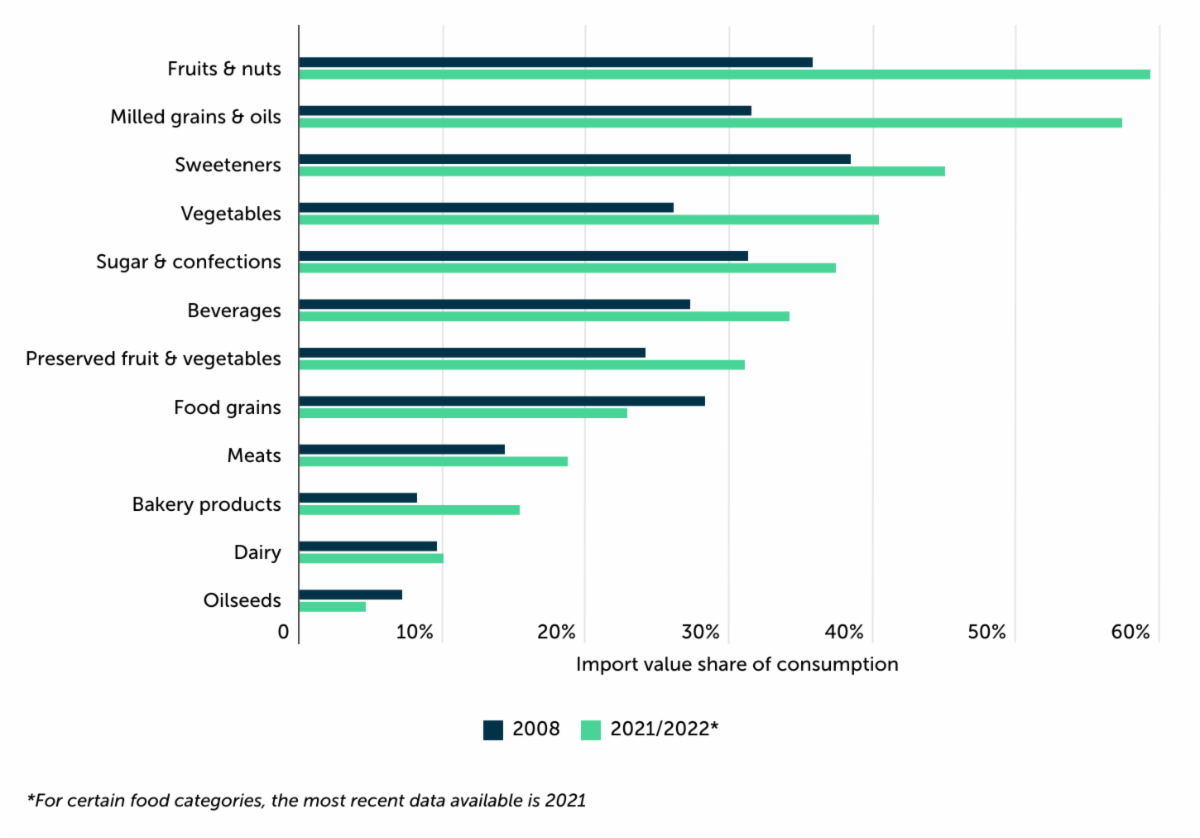

Imports as a share of consumption by food category

Nearly 60% of the fruits and nuts consumed in the United States are imported

Imported foods have become an increasingly important part of the American diet, with their share of nearly every food category rising in recent years. Between 2008 and 2022, the proportion of imports in total U.S. food and beverage consumption increased from 12.4% to 17.3%. However, the growing reliance on imported food is particularly evident in certain categories.

Fruits and nuts are one of the most import-reliant categories, with nearly 60% of the fruits and nuts consumed in the United States currently coming from abroad, up from 35.8% in 2008. Likewise, imports of milled grains and oils have also grown significantly and now account for 57.4% of consumption, compared with 31.5% in 2008. Other categories such as sweeteners and vegetables have also seen significant growth, with imports currently accounting for 45.0% and 40.4% of consumption respectively.

In addition to these categories, the United States relies heavily on imported seafood, with an estimated 70-85% of seafood consumed domestically coming from international sources. With tariffs and trade policies likely to change, a high reliance on imported goods could have a direct impact on food prices at the consumer level.

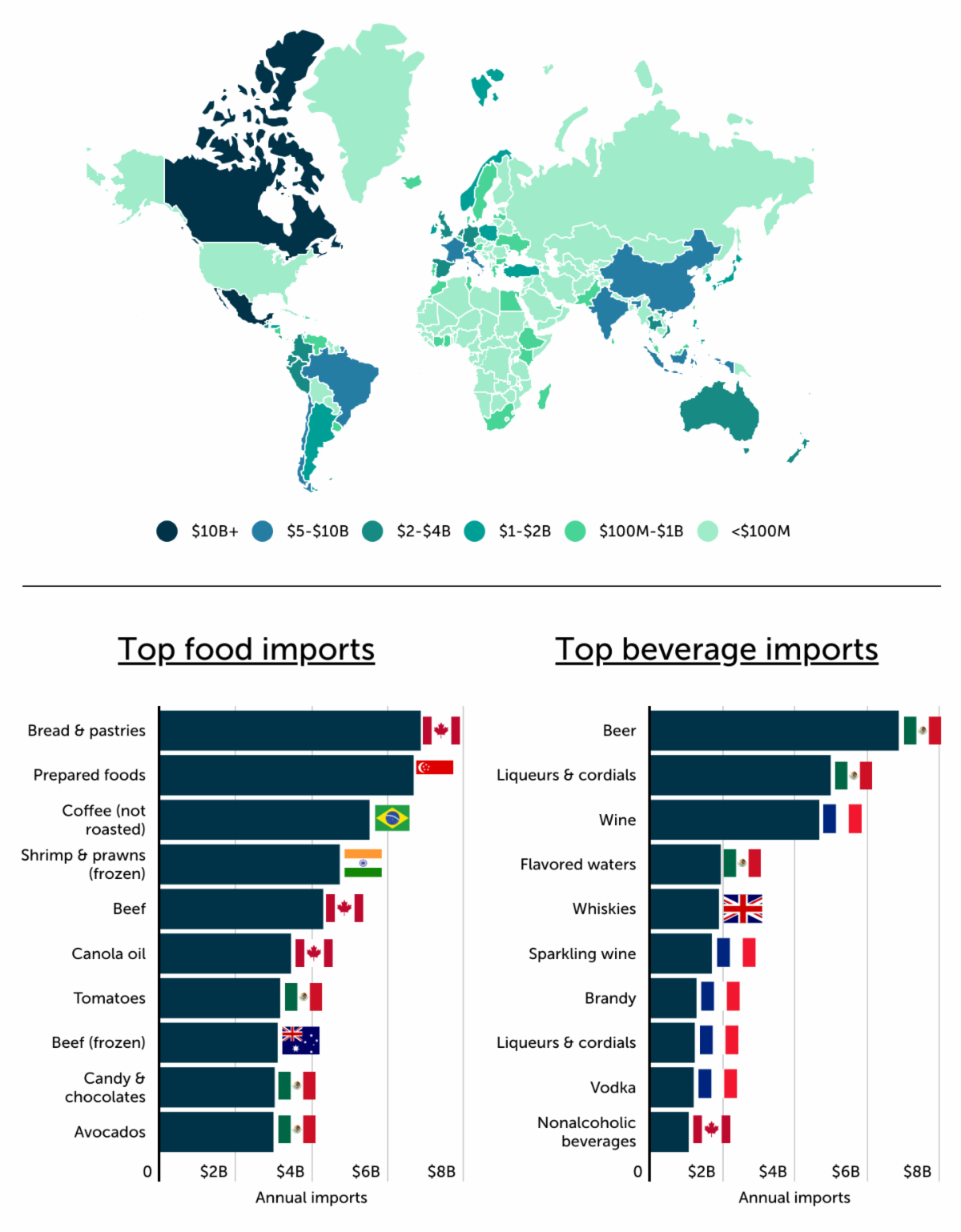

Main trading partners and imports

Food and beverage imports from Mexico and Canada account for 42% of total U.S. imports

At the country level, Mexico and Canada account for 42% of total U.S. food and beverage imports. In 2023, Mexico exported more than $44 billion in food, mostly beer, to the United States, while Canada exported $38 billion, with bread and pastries the leading category. Italy and France are among Europe’s largest exporters, and wine is their main export to the United States. Other important trading partners include Chile, which supplies salmon, and Brazil, a major source of coffee.

China, India and Indonesia are the main contributors in Asia, exporting a variety of products including oil and shrimp. Australia and New Zealand are important beef suppliers, while countries such as Peru and Vietnam export grapes and cashews respectively.

Within specific food categories, bread and pastries were the largest imported item, valued at nearly $6.9 billion. Prepared foods, coffee and frozen shrimp are also good value, while beer tops the list of drinks, followed by liqueurs, cordials and wine.

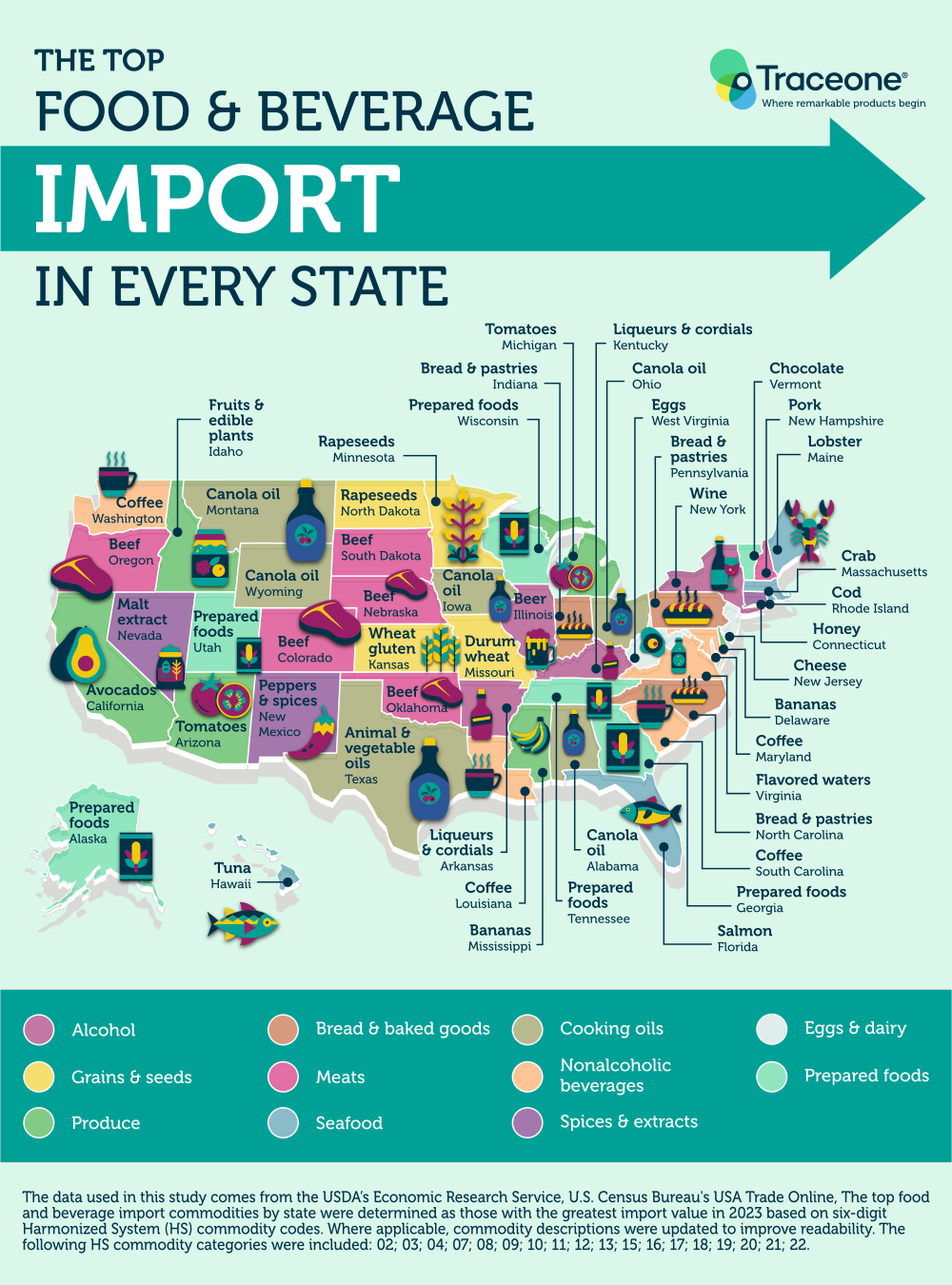

Top food and drink imports by state

The major foods and beverages imported vary widely from state to state, covering everything from cooking oils and prepared foods to meats, seafood, fresh produce and alcohol. Prepared foods, canola oil and beef all topped the list in five states. Coffee is the main imported product in four states, while bread and pastries dominate in three states. Interestingly, while beer is the nation’s No. 1 food and beverage import, Illinois is the only state to rank No. 1 for beer imports.

methodology

This study used data from the U.S. Department of Agriculture economic research servicesU.S. Census Bureau US Trade OnlineU.S. Census Bureau Family Intention Surveyand the U.S. Bureau of Economic Analysis’ Consumer spending by state.

The top food and beverage imports into the United States overall by country and state were identified as the items with the largest import value in 2023, based on the six-digit Harmonized System (HS) commodity code. Where applicable, product descriptions have been updated to improve readability. Including the following HS commodity categories: 02; 03; 04; 07; 08; 09; 10; 11; 12; 13; 15; 16; 17; 18; 19; 20; 21; 22.

Percent of adults experiencing food affordability challenges from Household Intention Survey Phase 4.2 Cycle 09. This number represents the proportion of respondents who said they could not afford more food. National-level food insecurity data covers the period 2021 to 2023, while national-level data only reflects the situation in 2023.

You can access the full report here

About trace one

Trace One is a global leader with over 30 years of experience specializing in regulatory compliance and PLM solutions for the food and beverage industry. His work has been featured in Newsweek, MSN, USA Today, ABC and other media. Additional insights are available upon request.

Leave a Reply Cancel reply

You must be logged in to post a comment.