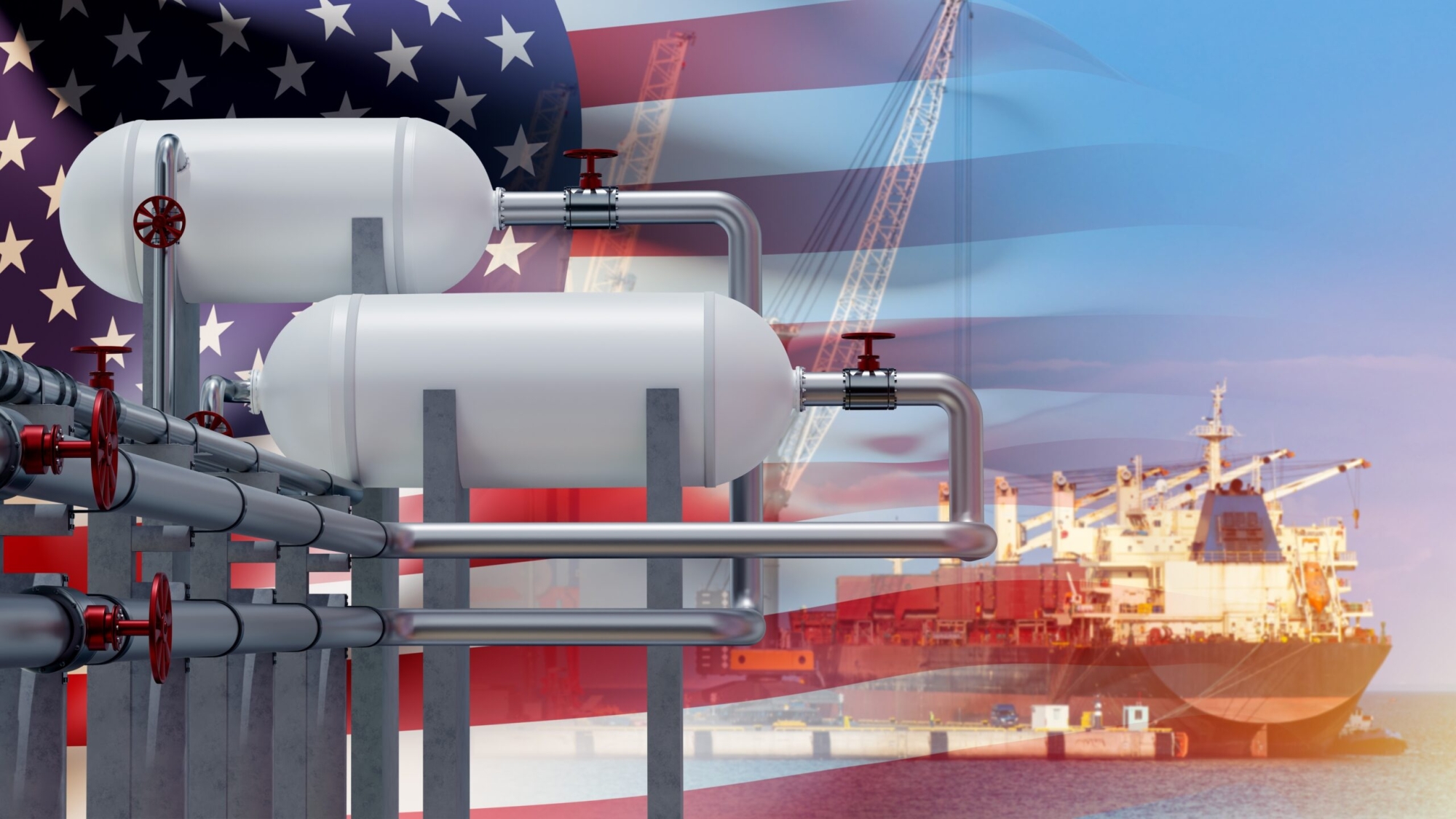

The Northern Hemisphere is experiencing its hottest summer on record, a time when air conditioning goes from a nice-to-have to a necessity and gas prices normally soar. Yet the abundance of natural gas around the world is prompting drillers to pump the brakes and limit supply.

Also read: AI-powered surge boosts U.S. natural gas demand

Much of the oversupply can be traced back to December. That winter was unusually warm, and there was a surplus of unburned natural gas. In March, the market was flooded with cheap gas, consumers were ecstatic, and producers sought a new round of production cuts. Prices rose slightly, but then plunged again as suppliers reduced output.

Big producers like Coterra Energy and EQT are riding the wave. It’s a delicate supply game that, in many ways, is at the heart of market economics. Once prices fall to a level where drilling and supplying gas is no longer profitable, producers withhold supply to compete.

The oil and gas industry as a whole has changed in recent years, focusing more on profitability than growth. CEO compensation plans previously encouraged production above all else, but the market is changing rapidly. If the ultimate goal is to control costs and return cash to shareholders, then producing what the world needs requires more from traders.

Natural gas production fell by more than 2 billion cubic feet per day in August. In February, there were about 120 natural gas rigs in operation, and now there are only 98. Part of the problem facing producers is the lag time between when production stops and when the reduction in production affects the market. It takes about six to nine months for a reduction in drilling to affect prices.

Once we get into October, demand will increase again. But analysts say there is enough natural gas in storage to keep U.S. consumers going through the winter at attractive prices. The amount of natural gas in storage is 13% higher than the five-year average. Natural gas futures are also at their lowest level since 2019, down 14% from a year ago, closing at $2.198 per million British thermal units in mid-August.

Leave a Reply Cancel reply

You must be logged in to post a comment.